Threads of Transformation: India's Textile Industry Weaving a Modern Future

Posted 20 Jun 2024

Updated 26 Jun 2024

5 min read

Introduction

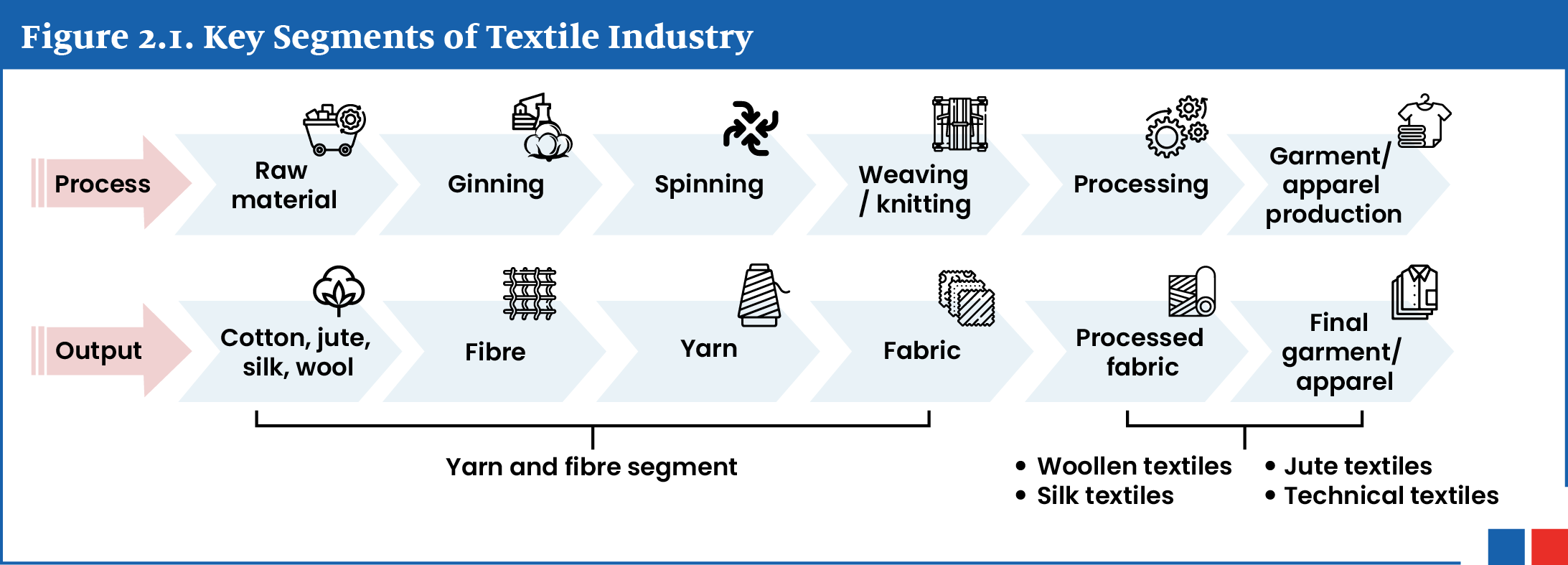

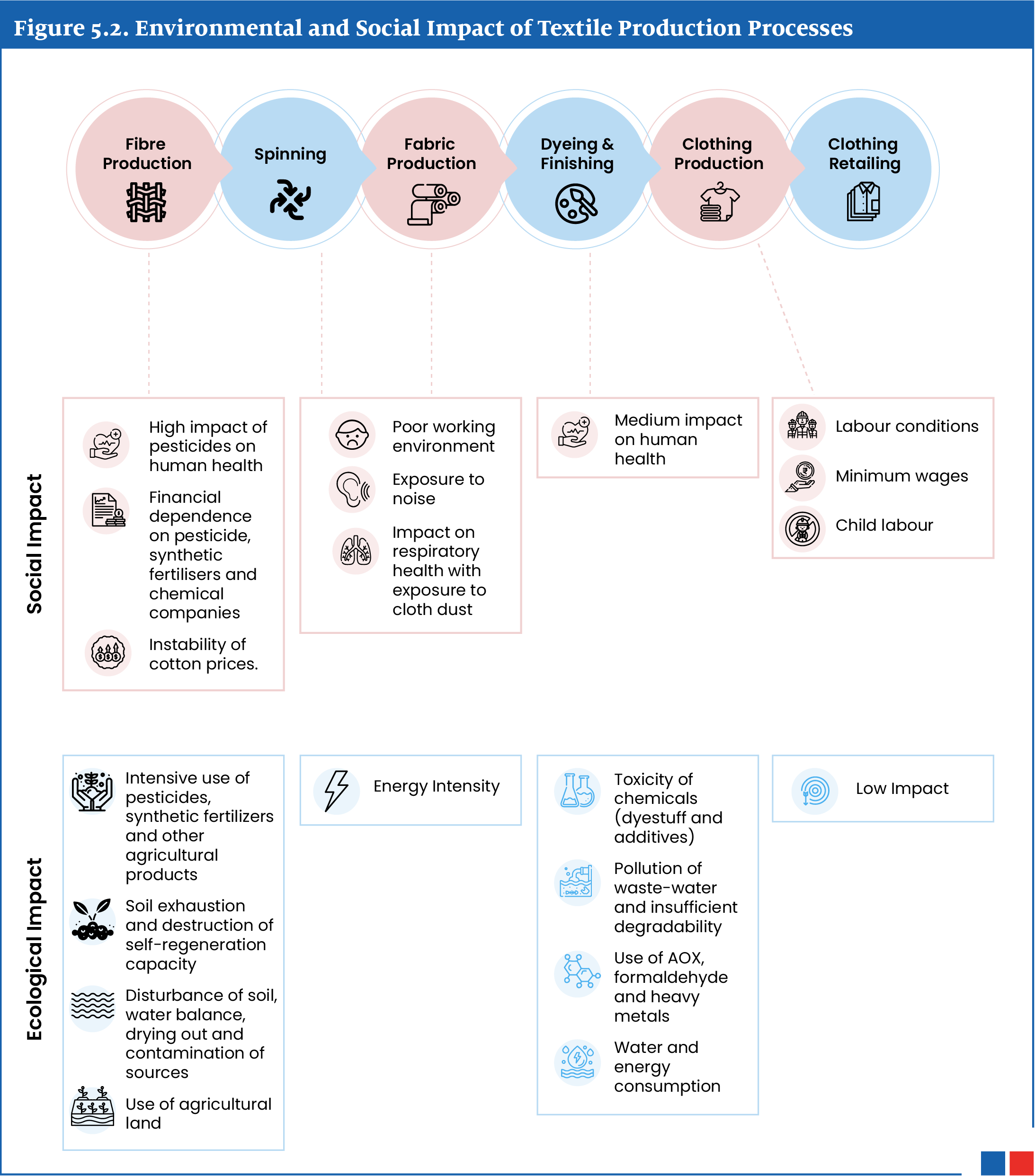

The textile industry is a vital sector of the Indian economy, with a rich history dating back centuries. The Indian textile manufacturing industry is diverse, encompassing a wide range of textiles, including apparel, home textiles, technical textiles, and traditional handloom textiles. However, it is marred by its traditional outlook, lacking in technology adoption and inefficient waste management. Various approaches including Circular Economy approach can help attain full realization of the sector potential.

1. What is the present status of the Textile Sector in India?

India's textile sector is a powerhouse of economic activity, providing livelihoods for millions and contributing significantly to the nation's economy.

- Contribution in Economy: Textiles and apparel industry contribute 2.3% to the country’s GDP, 13% to industrial production and 12% to exports.

- Employment: It is one of the largest employers (with direct employment to around 45 million workers) in the country, generating jobs across the entire value chain, from cotton farming and spinning to weaving, dyeing, printing, and garment manufacturing.

- Textiles production and export: India is the world’s second-largest producer of textiles and garments.

- It is also the sixth-largest exporter of textiles spanning apparel, home and technical products, having a 4% share of the global trade in textiles and apparel.

- India is set to achieve $250 Bn textiles production and $100 Bn exports by 2030.

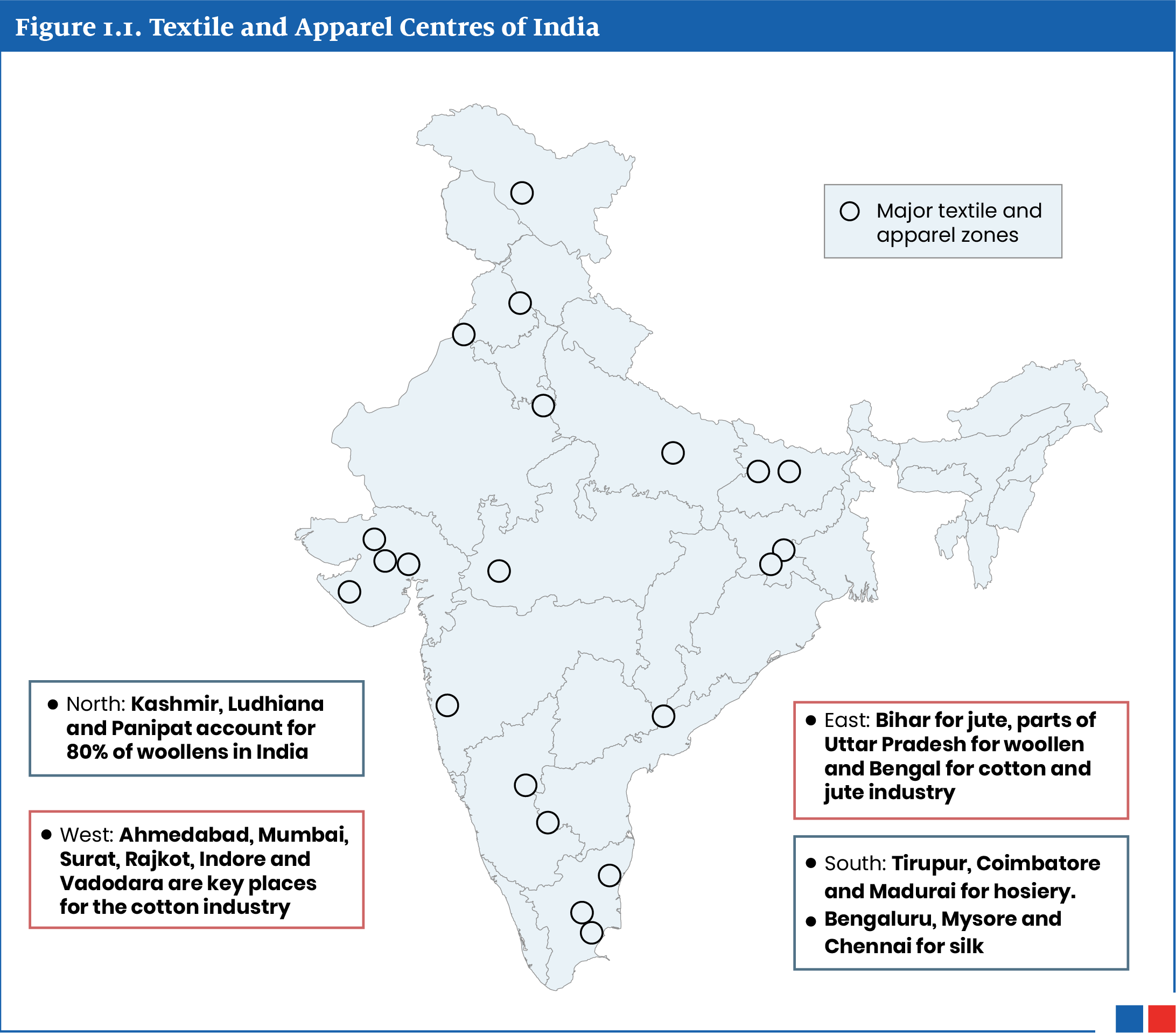

- Manufacturing Clusters: India has several textile manufacturing clusters, concentrated in regions like Gujarat, Maharashtra, Tamil Nadu, Uttar Pradesh, and West Bengal.

These clusters specialize in different segments, such as cotton textiles, silk textiles, and handloom textiles, and contribute significantly to India’s textile production and exports.

2. What are the constituent sub-sectors?

2.1. Cotton

- Commercial crop: Cotton is one of the most important commercial crops cultivated in India.

- Cotton grown in India: India is the only country which grows all four species of cotton, G. Arboreum & G. Herbaceum (Asian cotton), G. Barbadense (Egyptian cotton) and G. Hirsutum (American Upland cotton).

- Major producers: In India, majority of cotton production comes from 9 major cotton growing States, namely Punjab, Haryana, Rajasthan, Gujarat, Maharashtra, Madhya Pradesh, Telangana, Andhra Pradesh and Karnataka.

Status of Cotton Industry:

- Employment: Cotton plays a major role in sustaining the livelihood of an estimated 6 Mn cotton farmers and 40-50 Mn people engaged in related activity such as cotton processing & trade.

- Economic Significance: Cotton is one of the largest contributors to India’s net foreign exchange by way of exports in the form of raw cotton, intermediate products and finished products.

- Due to its economic importance to India, it is also termed as “White-Gold”.

- Area under cultivation: India is at first place in the world in cotton acreage with 130.61 lakh hectares area under cotton cultivation, i.e., around 40% of world cotton acreage.

- Approximately 67% of Indian’s cotton is produced in rain-fed areas and 33% on irrigated lands.

- In terms of productivity, India is at 36th rank with a yield of 447 kg/ha.

- Production: India occupies 2nd place in the world with estimated production of 343.47 lakh bales during cotton season 2022-23, i.e., 24% of world cotton production.

- India is also the 2nd largest consumer of cotton in the world.

Government Initiatives for Development of Cotton Sector:

- Minimum Support Price (MSP) Operations: Government supports the cotton farmers by procuring cotton under MSP, ensuring remunerative price to cotton farmers and saves them from distress sales in any eventuality of cotton prices falling below MSP.

- Mobile App “Cott-Ally”: It aims to increase the awareness among the cotton farmers about MSP of cotton, best farm practices and nearest procurement centres of CCI for selling their cotton.

- Modernized Processing and quality assessment: CCI engages Star Rated Modernized Composite Ginning & Pressing factories through tender system for processing of seed cotton procured under MSP operations.

- Manual systems are minimized by CCI in the procurement of cotton by using modern gadgets like moisture meters for scientific assessment of quality of cotton at the spot.

- Traceability of cotton: CCI is implementing QR code using Blockchain Technology for traceability from processing of cotton and warehousing till its e-auction sale to the buyers.

- Increasing productivity of Extra-long staple cotton (ELS): This ELS cotton is used to produce high valued fabrics and textile products which is in high demand in the world.

- Branding of Indian Cotton: Brand name for Indian cotton was launched as “Kasturi Cotton India” to attain the objective of making India Atmanirbhar and vocal for local in the field of cotton.

2.2. Technical Textiles

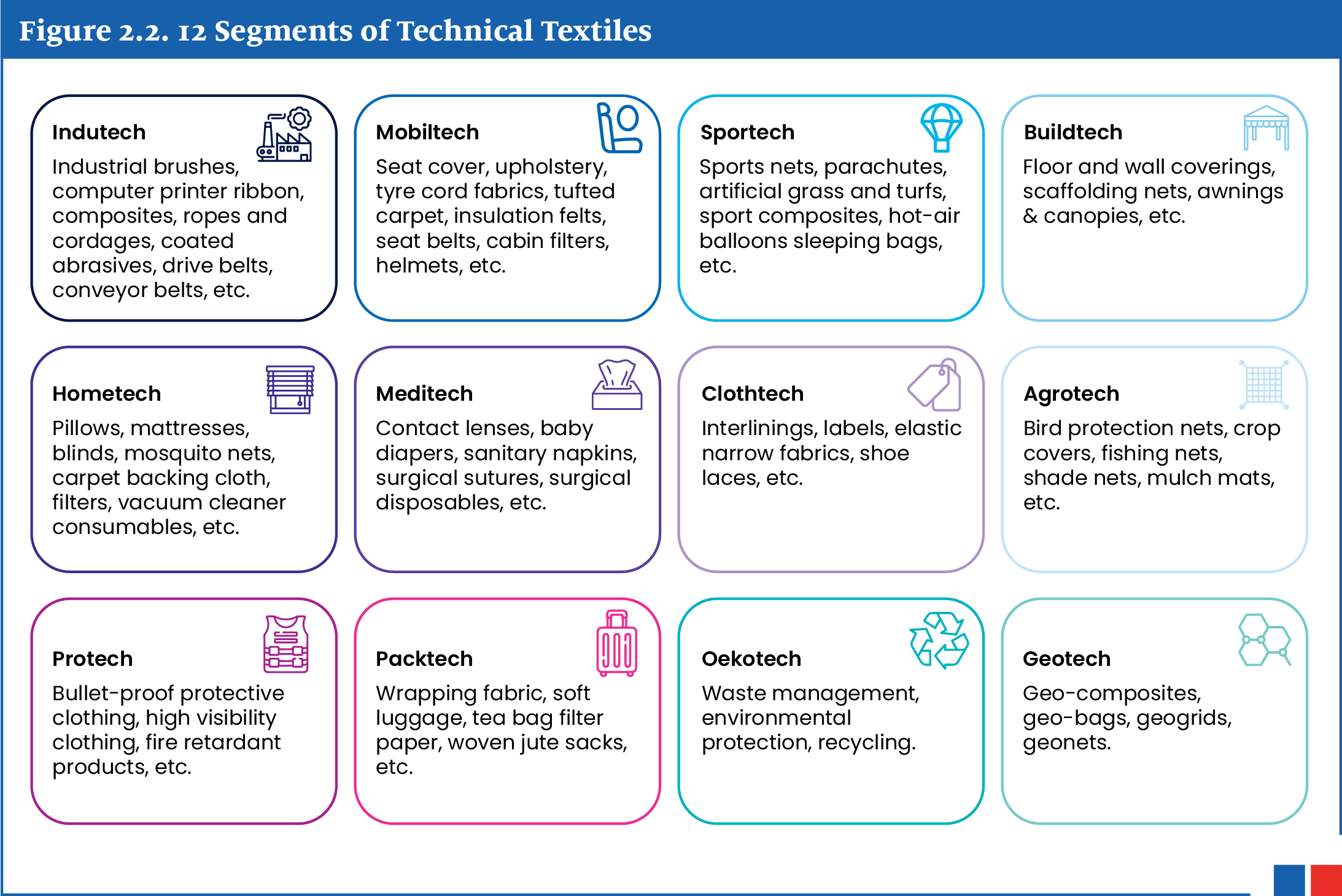

- Definition: Technical textiles are textile products that have technical performance and functionality rather than aesthetic and decorative features.

- Materials: Technical textile products are manufactured using natural as well as manmade fibres such as Nomex, Kevlar, Spandex, Twaron, etc.

- These fibres exhibit enhanced functional properties like higher tenacity, superior insulation, improved thermal resistance, etc., and are used in varied industries and applications.

- Categories: Technical textiles have been grouped into 12 categories: Agrotech, Meditech, Mobiltech, Packtech, Sportech, Buildtech, Clothtech, Hometech, Protech, Geotech, Oekotech and Indutech (see infographic).

Status of Technical Textile Industry

- Production: India is the 5th largest producer of technical textiles in the world with a market size of nearly $22 Bn.

- Exports: India is a net exporter and India’s exports of technical textile products grew from $2.21 Bn in 2020-21 to $2.85 Bn in 2021-22.

- India’s Textiles Exports were highest ever in FY 2021-22, crossing $44 Bn.

Government initiatives for Development of Technical Textiles Industry:

- National Technical Textile Mission (NTTM): Launched by Ministry of Textiles with a four year implementation period from FY 2020-21 to 2023-24. It has four components:

- Research, Innovation and Development

- Promotion and Market Development

- Export Promotion

- Education, Training, Skill Development

- Quality control regulations: 107 items identified to be brought under regulation to ensure quality.

- BIS Standards: Development of more than 500 BIS (Bureau of Indian Standards) standards for technical textiles.

- Centres of Excellence (CoEs): Government has established 8 CoEs for research and development in technical textiles.

2.3. Silk

Status of Silk Textile Industry:

- Production: India is also the 2nd largest producer of silk in the world and 95% of the world’s hand-woven fabric comes from India.

- Silk varieties: India is the only country which produces all varieties of silk including Mulberry, Tussar, Muga and Eri silk.

- Major producing states: Karnataka, Andhra Pradesh, Assam, Bihar, and Gujarat.

- Export desinations: India exports to USA, UAE, China, UK and Australia.

Government Initiatives for Development of Silk Textile Industry:

- Silk Samagra 2 (2021-26): It is an “Integrated Scheme for Development of Silk Industry” (ISDSI), a Central Silk Board initiative, comprising four core components:

- R&D, training, transfer of technology and I.T. initiatives,

- Seed organizations,

- Coordination and market development,

- Quality Certification Systems (QCS) / Export brand promotion, and

- Technology upgradation.

- National Silk Policy 2020: A vision to create a globally competitive and resilient silk sector meeting the needs of the present and future generations.

- Sericulture Development in the North-Eastern States (NERTPS): Launched within an umbrella scheme, namely “North-East Region Textile Promotion scheme” for revival, expansion, and diversification of sericulture with special focus on Eri and Muga silks.

2.4. Jute

- Jute, the golden fiber, meets all the standards for safe packaging because it is a natural, renewable, biodegradable, and eco-friendly product.

Status of Jute Textile Industry:

- Production: India is the leading jute goods-producing country globally, accounting for about 75% of estimated world production.

- Production areas: Jute is one the major industries in the north-east and eastern regions, particularly West Bengal, Assam, Bihar, Odisha and Andhra Pradesh.

- Export destinations: USA, France, the UK, the Netherlands, and Spain.

Government Initiatives for Development of Jute Textile Industry:

- MSP Operations: Government supports the industry through MSP operations by the Jute Corporation of India and through mandating 100% packaging of foodgrains and 20% of sugar in jute bags.

- National Jute Board (NJB): NJB runs various schemes for improvement in production including Improved Cultivations and Retting Exercises (ICARE), Jute Diversifications Scheme, Jute Resource-cum Production Centre (JRCPC), and Jute Retail Outlet scheme.

- Capital Subsidy for Acquisition of Plants and Machinery (CSAPM) Scheme: Implemented through NJB, it aims to provide financial assistance to the beneficiaries for the purchase of Jute diversified products (JDP) manufacturing machinery.

- Production Linked Incentive (PLI) Support on Jute Diversified Products (JDPs): It aims to make JDPs cost competitive globally.

2.5. Handloom & Handicrafts

Status of Handloom and Handicrafts Industry:

- Clusters: The major handloom clusters in India are in Varanasi, Godda, Shiva Sagar, Virudhunagar, Prakasam, Bhagalpur, Guntur and Trichy.

- Exports: India’s textiles products, including handlooms and handicrafts, are exported to more than 100 countries.

- The export of handicrafts (excluding handmade carpets) during Apr 2023 - Jan 2024 was $1522.9 Mn.

Government Initiatives for Development of Handloom & Handicrafts Sector:

- National Handloom Development Programme (2021-2026): It follows a needs-based approach and supports weavers, both within and outside the cooperative fold, towards raw material, design inputs, technology upgradation, concessional credit, and in creating permanent infrastructure in the form of Urban Haats, Mega Handloom Clusters, etc.

- At present, 9 Mega Handloom Clusters are under implementation in 8 States i.e., Assam (Sivasagar), Uttar Pradesh (Varanasi), Tamil Nadu (Virudhunagar and Trichy), West Bengal (Murshidabad), Jharkhand (Godda & neighbouring Distt.), Andhra Pradesh (Prakasam & Guntur Distt.) and Bihar (Bhagalpur) & Manipur (East Imphal).

- Comprehensive Handloom Cluster Development Scheme (2021-2026): Infrastructural support, market access, design and technology upgradation support, etc., will be provided to handicraft artisans under this scheme.

- Scheme for Skill Development in Handicraft Sector: It comprises 4 components: - Design and technology development workshops; Guru Shishya Hastshilp Prashikshan Programme; Comprehensive Skill Upgradation Programme; and Improved Toolkit Distribution Programme.

- Seven Design Resource Centres (DRCs) have been set up in Weavers’ Service Centres (WSCs) to build and create design-oriented excellence in the Handloom Sector.

2.6. Wool

Status of Wool Textile Industry:

- Production: India is the 9th largest wool producer in the world with major producing states being Rajasthan, Jammu and Kashmir, Gujarat, Maharashtra and Himachal Pradesh.

- Export destinations: USA, UK and Italy are the major importers of wool from India.

Government Initiatives for Development of Wool Sector:

- Integrated Wool Development Programme (IWDP): It aims to harmonise the wool supply chain, link the wool industry and producers, and provide a marketing platform to the smaller woollen products manufacturers in India.

- Its components include Wool Marketing Scheme (WMS), Wool Processing Scheme (WPS), Human Resource Development and Promotional Activities Scheme and the Pashmina Wool Development Scheme (PWDS).

- Central Wool Development Board (CWDB): Nodal agency under the Ministry of Textiles to implement wool sector schemes.

3. How are technological innovations helping the textile sector?

- Industry 4.0: Industry 4.0 offer a range of opportunities to the textile sector for improvement in design, productivity, delivery times, sustainable dyeing, predictive maintenance, and a solution to transparency.

- 3D Printing: Experimenting with 3D printing, combined with different interlocking structures, has resulted in a unique new material termed as “cellular textile”.

- Its uniqueness lies in the fact that even a small modification in the textile’s structure gives the fabric a completely new set of properties in terms of stretch and flexibility.

- Automation and Robotics: Systems that eliminate fabric distortion, using advanced computer vision and camera tracking the movement of fabric during stitching, have been designed to deliver high precision during stitching.

- For instance, SEWBOT technology use high caliber machine vision and real time analysis to adjust the fabric being stitched, automating the task.

- Blockchain: Blockchain and other Distributed Ledger Technologies (DLT) have potential to provide a traceability system for global supply chains as well as establish an indelible digital link between goods and their digital identity.

- Waterless Dyeing: Textile sector is one of the biggest water guzzlers in the industry. Dry dyeing or waterless dyeing uses a supercritical liquefied carbon dioxide to dye fabrics, making the process less water intensive.

- Nanotechnology: It allows the textile industry to manufacture functional clothing and technical textiles. For instance, fire repellent, self-cleaning, wrinkle free clothing.

4. What are the government initiatives for overall textile sector?

- PM MITRA: Pradhan Mantri Mega Integrated Textile Region and Apparel (PM MITRA) Parks Scheme aims to develop world class infrastructure including plug and play facility with an outlay of Rs. 4445 crore for a period up-to 2027-28.

- Centre and States will form Special Purpose Vehicles (SPVs) for setting up PM MITRA Parks, which will be developed in Public-Private Partnership (PPP) mode.

- PLI Scheme for Textiles (2021-2030): Intended to promote production of MMF Apparel & Fabrics and Technical Textiles products in India to enable textile industry to achieve size and scale and become globally competitive.

- Incentive will be provided to the companies on achieving the threshold investment and threshold turnover and thereafter incremental turnover.

- Amended Technology Upgradation Fund Scheme (ATUFS): It is a credit linked Capital Investment Subsidy (CIS) scheme to catalyze capital investments for technology upgradation and modernization of the textile industry.

- Scheme for Capacity Building in Textile Sector (SAMARTH) scheme: It aims to provide demand driven and placement oriented National Skill Qualification Framework (NSQF) compliant skilling programmes to incentivize job creation in the organised textile sector.

- Scheme for Integrated Textiles Park (SITP): To facilitate textile units to meet international and environmental standards by providing support for common infrastructure and buildings within parks.

- Foreign Direct Investment (FDI): 100% FDI (automatic route) is allowed in textile and apparel sector in India.

- Textiles (including Dyed, Printed) has attracted over $4.42 Bn of FDI during Apr 2000 to Dec 2023.

- SAATHI (Sustainable and Accelerated Adoption of Efficient Textile Technologies to Help Small Industries): To sustain and accelerate the adoption of energy efficient textile technologies in the powerloom sector.

5. What are the challenges the sector is facing?

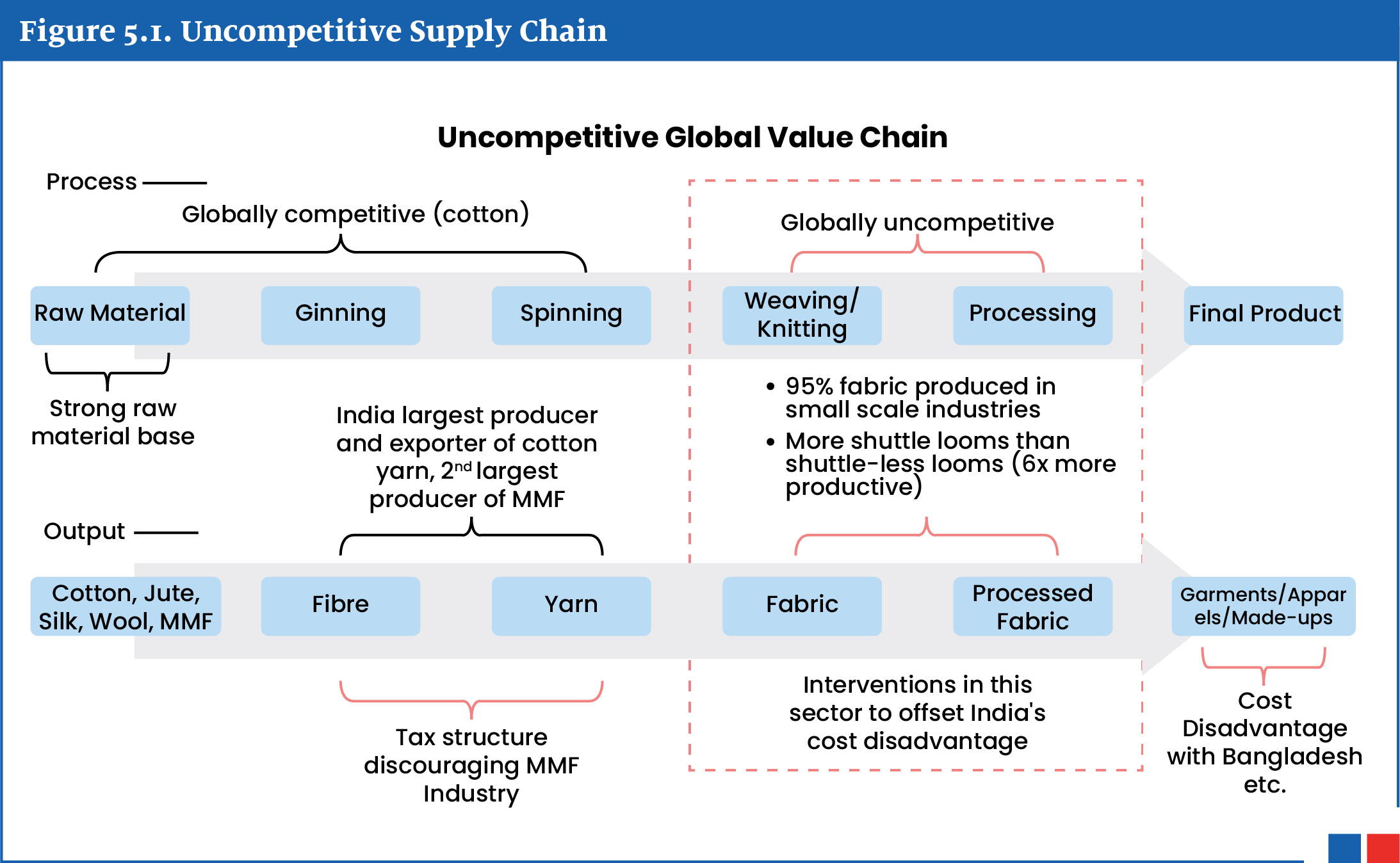

- Uncompetitive Global Value Chain (GVC): While India has the advantage of the entire value chain in the industry, currently the value chain is uncompetitive.

- Quality of raw material: India has a strong raw material base and is largest producer of cotton but high contamination level and poor quality of fibre, both in fineness and length, are major concerns.

- Fragmented nature: Sector is highly fragmented with a large number of MSME players, with lack of product diversification, stagnation of exports and over reliance on domestic consumptions.

- Lack of technological advancement: Sector lack technological advancements due to fragmented nature despite it being a highly resource intensive industry.

- Globalization: Globalization has significantly affected the garment industry by increasing competition and moving production to lower cost labour countries.

- In cotton yarn, India has lost market share over the past decade to Vietnam and China because of high cost and lack of FTAs (Free Trade Agreements).

- Also, three major factors of production viz. land, labour and capital are costlier in India than other competitive economies like Bangladesh, Philippines, Vietnam etc.

- BT Cotton seeds: In India, 94% of the seeds are genetically-modified BT Cotton. The problem with genetically-modified seeds is that the farmer has to buy it every year while in other varieties he can produce the seed on his own and use it.

- Weaving sector as weakest link: The weaving sector remains one of the weakest links as the cost of production is high due to poor technology levels, low productivity and low scale of operations.

- Also, 95% of the weaving sector in India is unorganized.

- Handloom Sector: The handloom sector is beset with problems such as technological obsolescence, low productivity, inadequate working capital, weak marketing links, and competition from powerloom sectors.

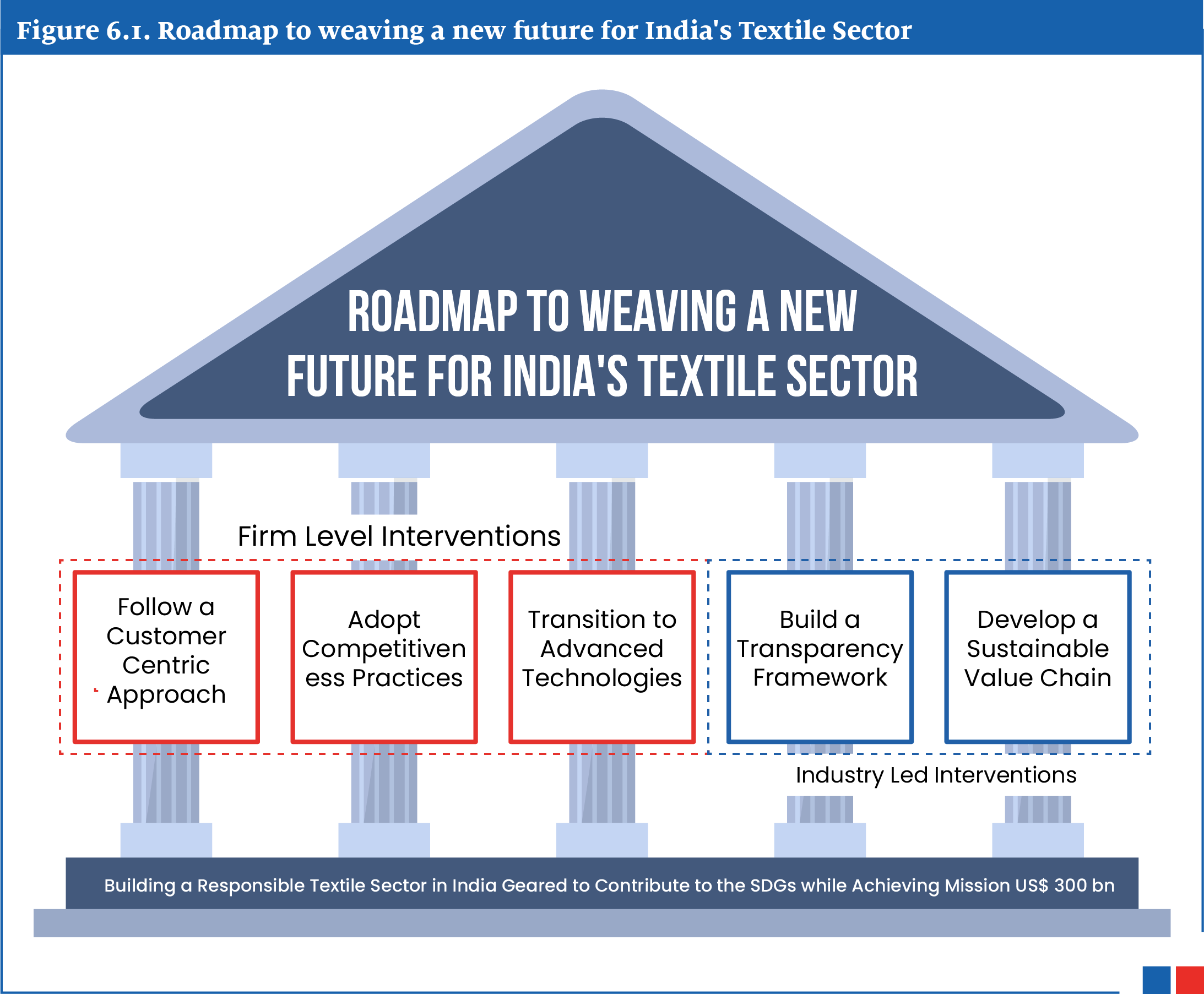

6. What can be done to achieve the sector’s potential?

- Technology upgradation: In order to make the textile industry competitive, industry needs to focus on investing in technology upgradation and in capabilities and R&D.

- Given that India is a global leader in IT and Software development, the country stands at an advantage with abundance of talent and availability of resources to provide low cost automation and digital solutions.

- Strengthen weaving and processing sectors: Under ATUFS, the weaving sector may be considered to get capital subsidy at par with garmenting and technical textiles.

- At present, the weaving sector is getting subsidy at 10% subject to cap of 20 crore under ATUFS, whereas for garmenting and technical textiles, subsidy is provided at 15% subject to cap of 30 crore.

- Adopt Competitiveness Practices: Manufacturing excellence advocates achieving higher production with reduced labour effort, reduced inventories, reduced wastage and can be achieved through Textile Excellence Clusters.

- Locomotive companies, one that takes the lead in transforming itself becoming a role model for others, could take the lead.

- Support from State Governments: State governments should aggressively promote infrastructure and provide plug and play parks for the industry. Lands should be allotted in such parks for long-term lease.

- Sustainability: India should focus on revamping processes including circular designs, use of blended fibres, zero liquid discharge, chemical management, and revamping policies including safety at workplace.

- 5F vision, referring to the entire value chain from Farm to Fibre, Fibre to Fabric, Fabric to Fashion, and finally Fashion to Foreign, advocates incorporation of sustainable practices.

- Focus on High-End Global Value Chain: India should explore diversification of the export basket and explore other markets such as Japan, Australia, Africa etc.

- Leveraging opportunities in Technical Textiles: India should further build on strategic international collaborations for transfer of technology and bring in new processes and products.

Conclusion

India's textile industry stands at a crossroads, poised to transform myriad challenges into opportunities. By embracing technological advancements, adopting sustainable practices, and fostering collaboration across the value chain, India can weave a brighter future for its textile sector. This will not only bolster the industry's socio-economic contribution but also enhance its global competitiveness, ensuring that India remains a leader in the global textile landscape.

- Tags :

- Textile Sector

- Technical Textiles

- National Technical Textile Mission

Circularity in Textile Structure