Why in the News?

India and South Africa opposed the China-led IFDA proposal at the World Trade Organization (WTO).

About IFDA

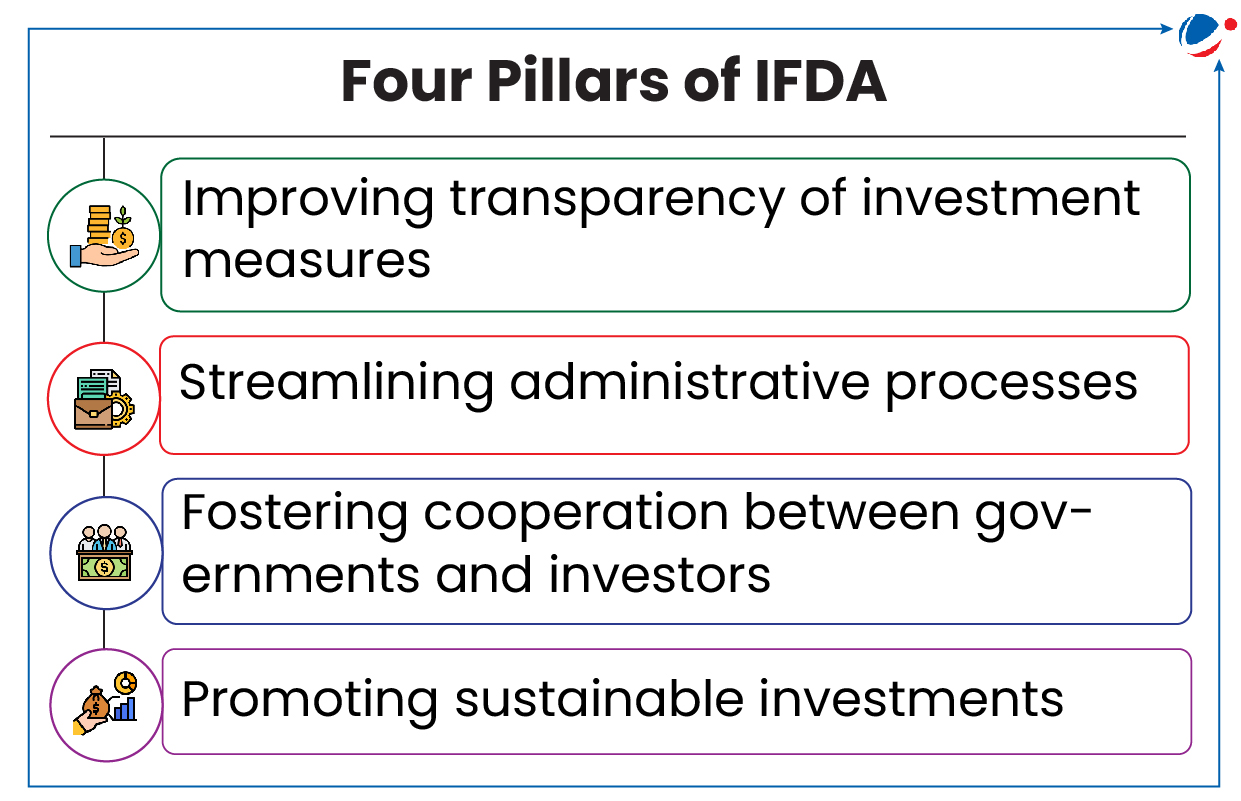

- Genesis: First mooted in 2017 by China and other developing and least-developed (LDCs) WTO member countries recognizing trade and investment as twin engines of economic growth and sustainable development.

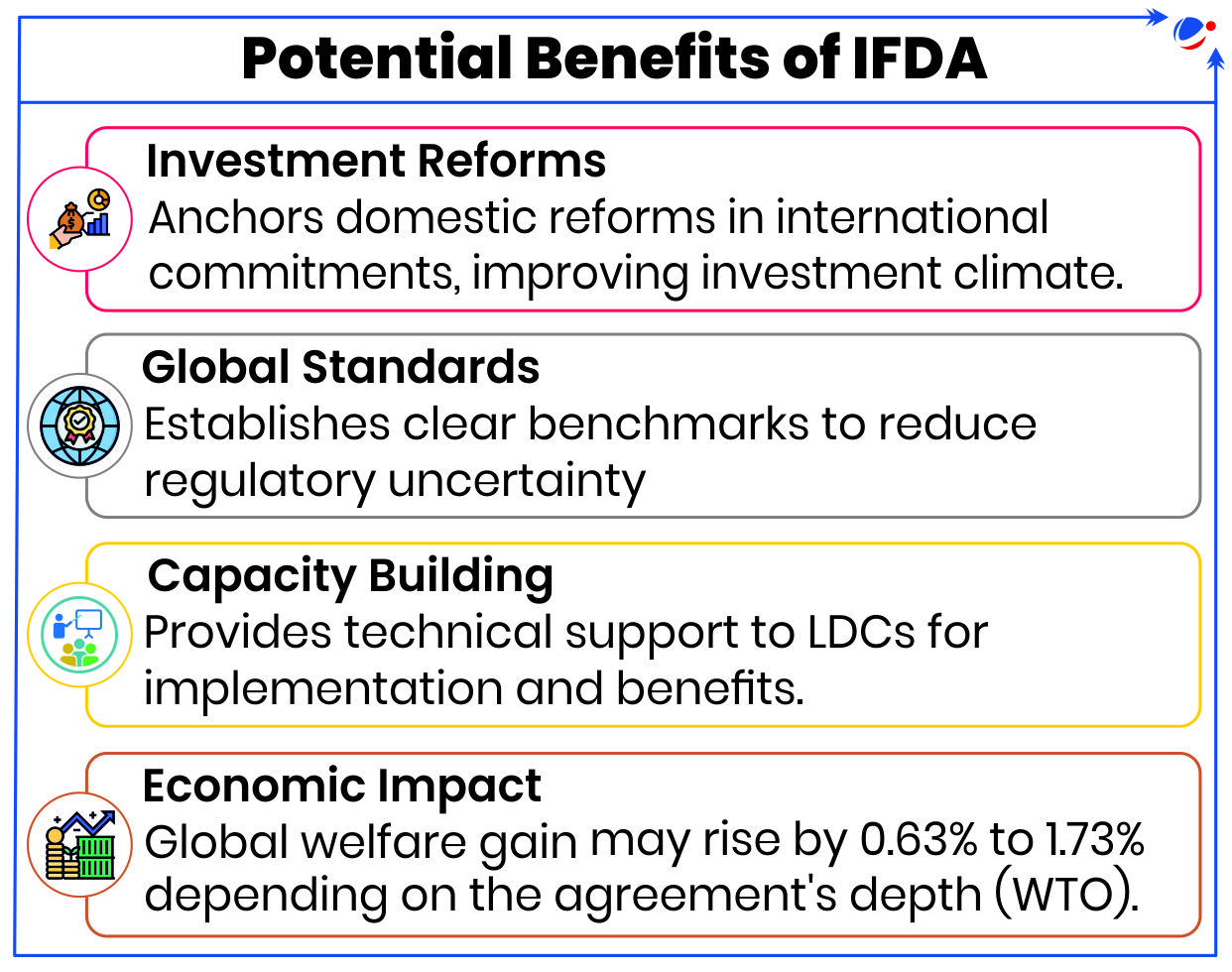

- Objective: To create legally binding provisions to increase global flows for Foreign Direct Investment (FDI), especially to developing economies and LDCs, to foster sustainable development.

- Plurilateral agreement: While the IFD Agreement will be plurilateral (binding only on those members that accept it), it is open for all WTO members to join.

- Provisions for plurilateral agreements are outlined in Annex 4 of the WTO Rule Book.

- Based on Most-Favored-Nation (MFN) Principle: "MFN" treatment requires Members to accord the most favourable tariff and regulatory treatment given to the product of any one Member at the time of import or export of "like products" to all other Members. This is a founding principle of the WTO.

Reasons for India's Opposition to IFDA

- Jurisdictional and Structural Issues: India maintains that Investment is not a trade issue and WTO lacks mandate over investment matters. Also, existing agreements (GATS and TRIMs) already cover trade-related investment aspects.

- Opposition to Plurilateralism: India views the plurilateral approach as a threat to WTO's multilateral foundation and also contradicts WTO's Doha Declaration requiring explicit consensus.

- Chinese Leadership Issues: Given China's history of debt-trap diplomacy and strategic investments through the Belt and Road Initiative, India sees potential risks in formalizing such investment frameworks.

- Sovereignty Concerns: Could boost foreign corporate lobbying and may put diplomatic pressure on weaker economies limiting national regulatory powers. Also, the agreement might prioritize foreign investors over domestic interests.