Key suggestions included focus on improving business performance, upgrading digital technology services and tapping business growth potential in MSME clusters.

About RRBs

- They are established under the RRB Act, 1987 based on the recommendation of Narasimham Working Group (1975).

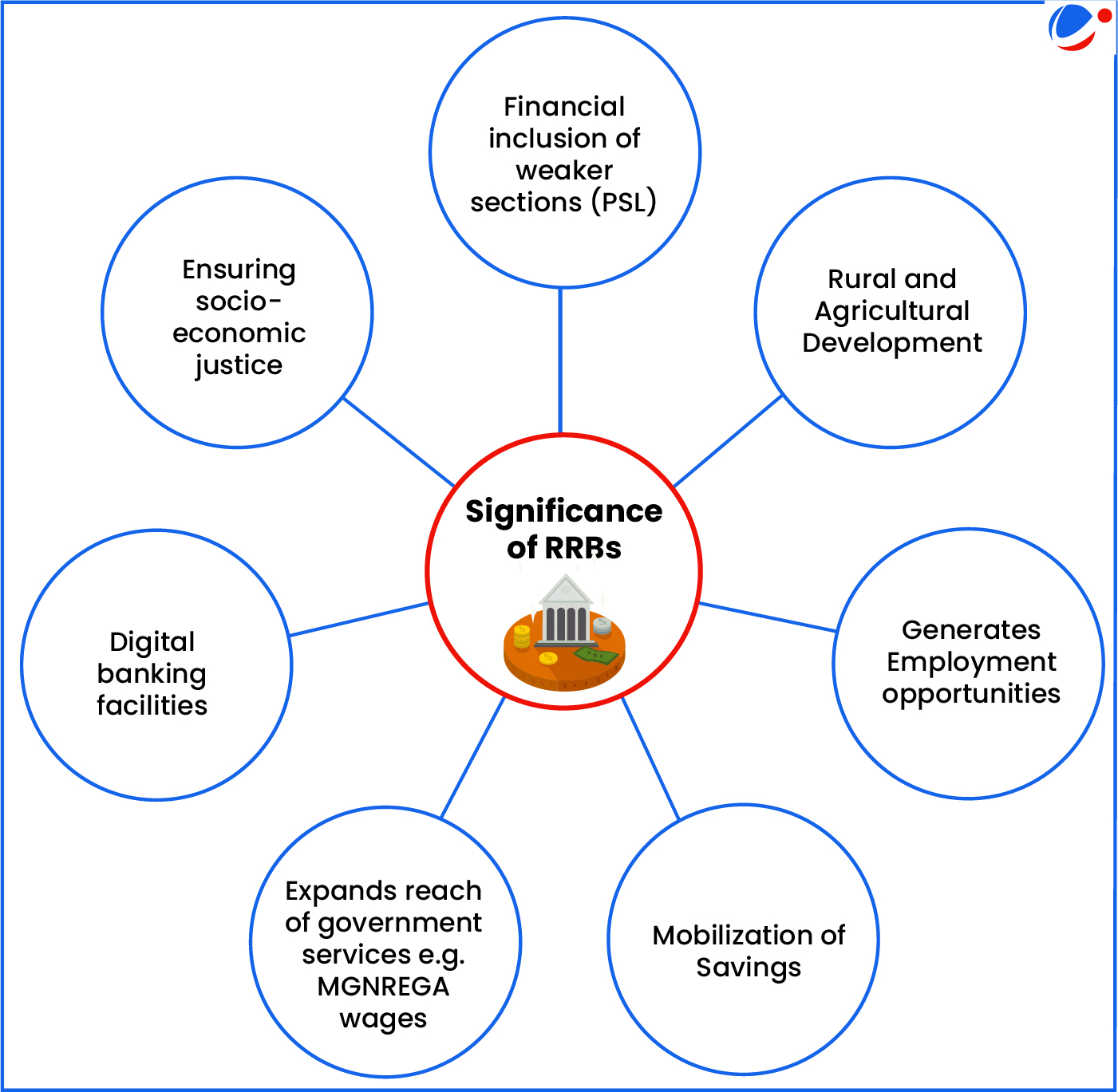

- Aim: To provide banking and credit facilities for agriculture and other rural sectors.

- There are 43 RRBs presently in India.

- They are jointly owned by Government of India, State Governments and Sponsoring Commercial Banks (50:15:35).

- They are Scheduled Commercial Banks (Government Banks) regulated by RBI and supervised by NABARD.

- Created primarily for rural areas, however, may also set up branches in urban areas.

Issues with RRBs

- Lack of coordination in Branch expansion: Results in inequitable distribution.

- Difficulties in Deposit mobilization: Practical exclusion of the richer rural population restricts deposit mobilization.

- Issues with human resource: High attrition rate due to availability of more attractive jobs. (urban orientation)

- Loans by Commercial Banks are more attractive due to lower interest rates for weaker sections.

Way Forward

- Structural consolidation to improve efficiency.

- Recapitalization of RRBs for capital augmentation.

- Periodic review and capacity building of human resources.