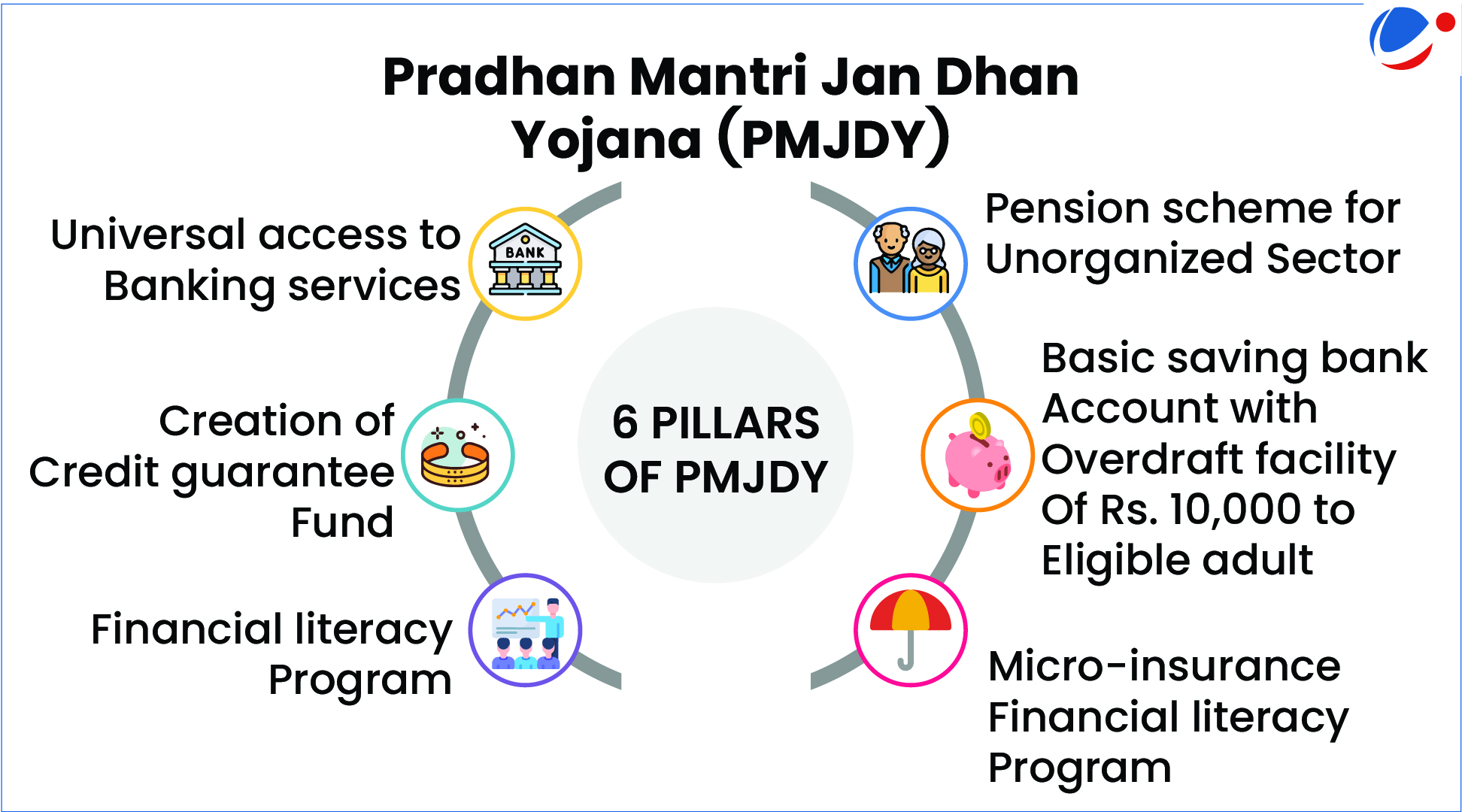

PMJDAY was launched in 2014 under Ministry of Finance to ensure access to financial services, namely, Basic Savings Bank Account (BSBA), remittance, credit, insurance, pension in an affordable manner.

Key features of PMJDY

- BSBD account can be opened in any bank branch or Business Correspondent (Bank Mitra) outlet, by persons not having any other account.

- Focus on every unbanked adult.

- Free accidental insurance cover on RuPay cards increased from Rs. 1 lakh to Rs. 2 lakhs for PMJDY accounts after 28.8.2018.

- Rs 10,000 Overdraft (OD) facilities and upper age limit for OD is 65 years.

- PMJDY accounts are eligible for Direct Benefit Transfer, Pradhan Mantri Jeevan Jyoti Bima Yojana, Pradhan Mantri Suraksha Bima Yojana, Atal Pension Yojana, Micro Units Development & Refinance Agency Bank scheme.

Key-achievements under PMJDY

- By July 2024, 52.74 crore Jan Dhan accounts were opened.

- More than 55% accounts holders are women.

- Almost 100% of villages are covered with banking outlets within 5 km mapped as per Jan Dhan Darshak App.

- Average Deposit in PMJDY accounts increased by 4.12 times between 2015- 2024.

- Number of zero balance accounts decreased to 4.26 crores as against 8.52 crores in March 2015.