Why in the news?

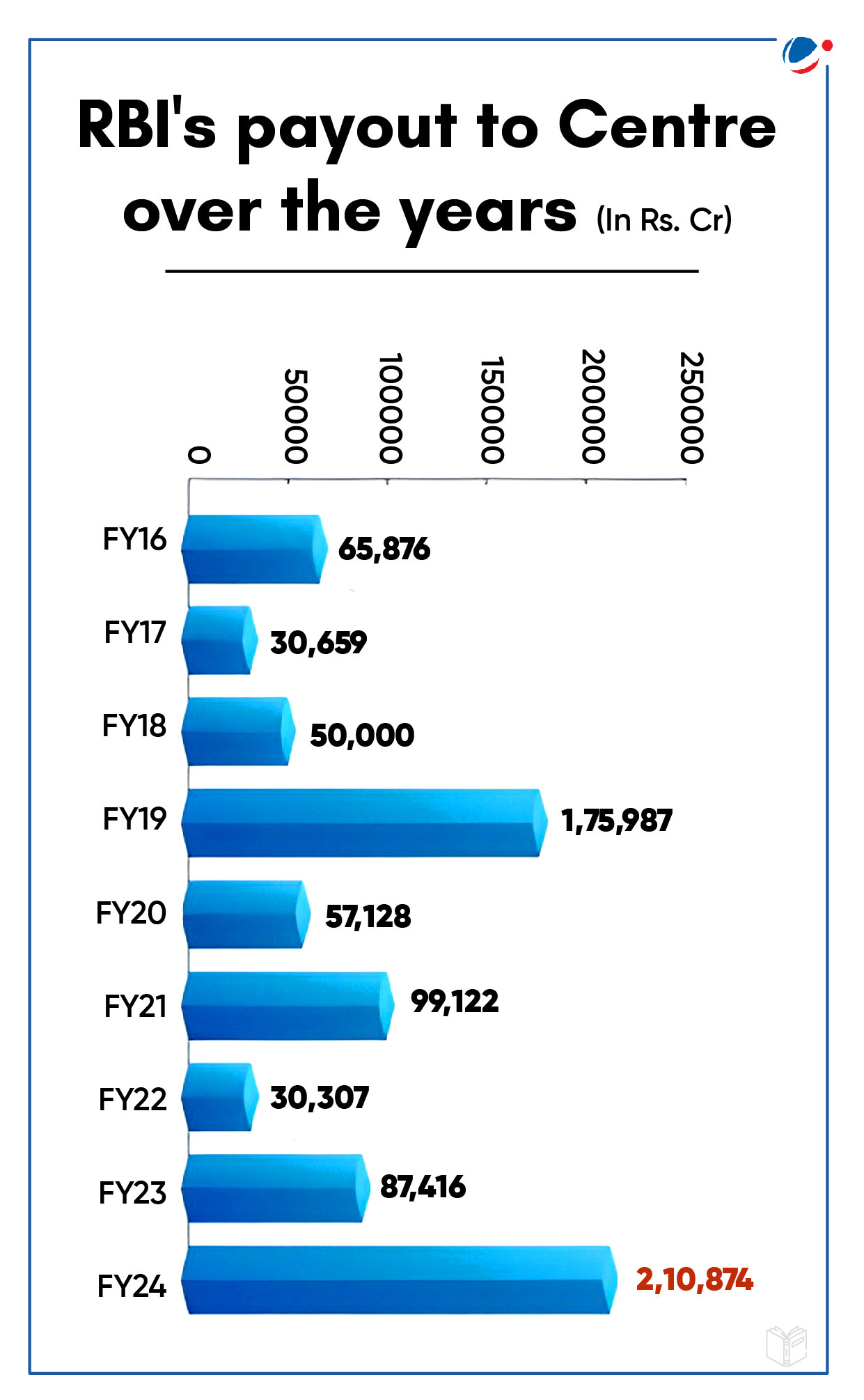

Reserve Bank of India (RBI) approved highest-ever surplus transfer of Rs 2.11 lakh crore to government for FY24 which is more than double the previous year's ₹86,416 crore.

More about the news

- The sharp jump in the surplus amount could be attributed to higher income from the forex holding of the central bank, among other factors.

- The surplus transfer is for the fiscal year 2023-2024, but will reflect in the government's account in the fiscal year 2024 - 25.

About RBI Surplus

- Surplus implies excess of income over expenditure. RBI's total expenditure is only about 1/7th of its total net interest income, thereby generating surplus.

| RBI's Income | RBI's Expenditure |

|

|

Provisions regarding RBI transfer surplus to the government

- RBI Act, 1934: Under section 48 of the RBI Act, 1934, the RBI is not liable to pay income tax or super tax on any of its income, profits or gains. However, it transfers its surplus to Government after making provisions for contingency funds and ADF.

- Section 47 of the RBI Act, 1934 mandates that any profits made by the RBI from its operations be sent to the Centre.

- Committees' recommendations: Earlier, RBI used to keep a major chunk of this surplus for its Contingency Fund (CF) and Asset Development Fund (ADF). However, after the Malegam Committee (2013) recommendations its transfer of surplus to government increased.

- Various committees i.e., V Subrahmanyam (1997), Usha Thorat (2004), Y H Malegam (2013) and Bimal Jalan (2018) were formed to decide the ideal amount of surplus transfer.

- Economic Capital Framework (ECF): It provides a methodology for determining the appropriate level of risk provisions and profit distribution to be made under Section 47 of the RBI Act, 1934.

- As per this Revised ECF recommended by Bimal Jalan Committee, the amount of surplus that the RBI must transfer to the Centre is determined based on two factors -

- Realized equity (essentially existing amount in CF): The CF is maintained within a range of 6.5% to 5.5% of the RBI's balance sheet and the excess amount is to be transferred to the government.

- The RBI's Central Board decided to maintain the realized equity level at 5.5%.

- Economic capital (essentially CGRA): It should be kept in the range of 20.8-25.4% of the balance sheet and rest should be transferred to government.

- CGRA includes its capital, reserves, risk provisions and revaluation balances which are unrealized gains, net losses resulting from movement of exchange rate, gold price or interest rate.

- Realized equity (essentially existing amount in CF): The CF is maintained within a range of 6.5% to 5.5% of the RBI's balance sheet and the excess amount is to be transferred to the government.

- As per this Revised ECF recommended by Bimal Jalan Committee, the amount of surplus that the RBI must transfer to the Centre is determined based on two factors -

Benefits of Surplus Transfer for Government

- Reduce Fiscal Deficit: It will help the government to meet the 5.1 % fiscal deficit target it has set for the fiscal year 2024-25.

- Meeting Revenue Targets: It's an important source of non-tax receipts for the government and helps the government to spend more to ensure economic growth in the economy.

- Reduce Government Borrowing: It may help government to reduce its gross borrowing for the current financial year (2024-25/FY25) by up to Rs 1 trillion or to step up capital expenditure.

- If the government borrows less, government security (G-Sec) yields could soften, thereby lowering its borrowing cost.

- Keeping Interest Rates Low: A fall in government bond yields mainly due to surplus transfer lowers borrowing costs across the economy as sovereign debt yields are the benchmarks for determining the price of corporate borrowing.

Conclusion

In the past, surplus transfers by RBI have been subject to debate on issues like Adequate Contingency Fund with the RBI and the Autonomy and credibility of RBI. However, the current surplus transfer by the RBI constitutes an important element which is considered by the Central Govt. in arriving at overall budget provisions for the fiscal year. These additional funds can be utilized for public spending or specific projects, which could lead to a revival in demand in certain sectors and boost economic activity.