Why in the News?

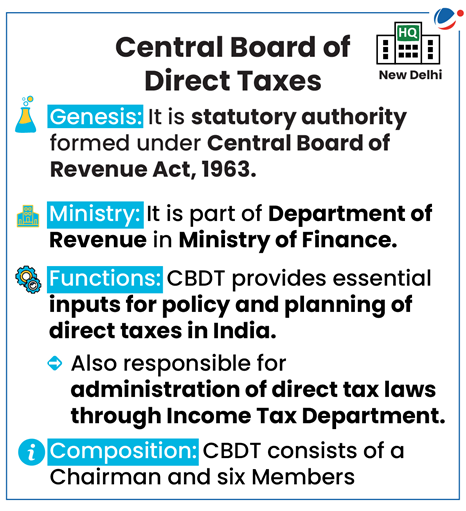

The Central Board of Direct Taxes (CBDT) has signed highest ever record 125 APAs (including Unilateral and Bilateral APAs) in FY 2023-24 with Indian taxpayers.

About Advance Pricing Agreements (APAs)

- It is an agreement between a taxpayer and tax authority.

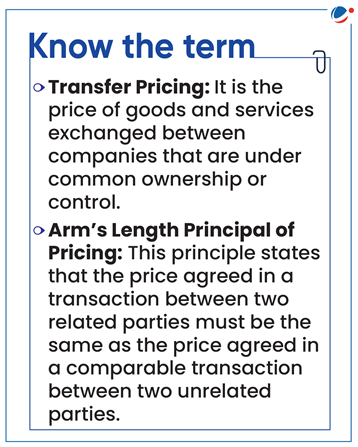

- APAs endeavors to provide certainty to taxpayers in domain of transfer pricing by specifying methods of pricing.

- APA helps determine arm's length price (ALP) of international transactions in advance for a maximum of five future years.

- Further, taxpayer has option to roll back APA for four preceding years, as a result of which, tax certainty is provided for nine years.

Types of APAs

- Unilateral APA: It involves only the tax payer and the tax authority of the country where the tax payer is located.

- Bilateral APA: It includes the taxpayer and tax authority of the country where the taxpayer is located, as well as an associated enterprise (AE) of the taxpayer in another country, along with the corresponding foreign tax authority.

- Multilateral APA: It involves tax payer, two or more AEs of tax payer in different foreign countries, tax authority of the country where the tax payer is located, and the tax authorities of AEs.

Mutual Agreement Procedure:

|

Significance of APAs

- Double Taxation Avoidance: Clarity with respect to tax outcome of the tax payer's international transactions reduces the risk of potential double taxation.

- Promoting ease of doing business: Especially for Multinational entities which have a large number of cross-border transactions within their group entities.

- Reduction of compliance costs to companies: It eliminates risk of future tax audit and time consuming tax related litigation.

- Reduced cost of administration: Due to reduced future tax litigation, reduced time and effort are needed on audit tasks by tax authorities and consequently it also frees scarce resources of government.

- Less burden of record keeping: As the taxpayer knows in advance the required documentation to be maintained to substantiate the agreed terms and conditions of the agreement.

Indian Advance Pricing Agreement Regime:

APA Scheme in India:

- Ministry of Finance had notified APA Scheme in 2012 through the insertion of sections 92CC and 92CD in the Income-tax Act, 1961.

- APA rules were notified by CBDT subsequently.

- Under it, an agreement is signed between CBDT and any person determining in advance arm's length price in relation to an international transaction.

- Nature of Scheme: APA process is voluntary and supplements appeal and other Double Taxation Avoidance Agreement (DTAA) mechanism for resolving transfer pricing dispute.

- Term of APA: Maximum five years.

- Rollback provisions: Allows Arm's Length Price as agreed in APA, to be rolled back to a period prior to the commencement of the APA.

Issues with Advance pricing Agreement in India:

- Complex International transactions: Many international transactions involve intricate business structures and operations, making it challenging to accurately determine arm's length prices.

- Lack of Internal Co-ordination: It has been experienced that different entities take different technical positions on similar international transactions. Creating uncertainty for taxpayers and stalling of APA negotiations.

- Delay in Processing APAs: Scarce human resources allocated to the process leads to delay in processing as process is usually fact intensive and need a lot of data analysis.

Conclusion

Apart from reducing company's compliance requirements as well as forging strategies for dispute prevention, APA program has also assured revenue flow to the Indian treasury. To address APA issues, Outsourcing subject matter experts from private sector can not only solve human resource crunch issue but will also bring clarity to emerging complexities with their expertise.

Related NewsDouble Taxation Avoidance Agreement (DTAA)

Base Erosion and Profit Shifting (BEPS)

|