Why in the news?

Reserve Bank of India released the Annual Report of the Ombudsman Scheme 2022-23.

More on the news

- It is the first stand-alone report under the Reserve Bank – Integrated Ombudsman Scheme (RB-IOS), 2021.

- It elucidates the activities of the 22 Offices of the RBI Ombudsman (ORBIOs), the Centralized Receipt and Processing Centre (CRPC) and the Contact Centre during the year.

Key Findings of Annual Report of Ombudsman Scheme 2022-23

- Complaints: Around 7 lakh complaints were received at ORBIOs and CRPC during FY 2022-23, showing an increase of 68.24% over last year.

- Mode of complaint: Around 85.64% of the total complaints were received through digital modes.

- Disposal Rate: Overall disposal rate for FY 2022-23 at the ORBIOs stood at about 98% with an average Turn Around Time (TAT) of 33 days.

- Majority of maintainable complaints (57.48%) disposed of by ORBIOs were resolved through mutual settlement/conciliation/mediation.

- Regulated Entities (REs): Complaints against banks formed the largest portion, accounting for 83.78% of complaints received by the ORBIOs.

Major reasons for increasing complaints:

|

Reserve Bank – Integrated Ombudsman Scheme (RB-IOS), 2021

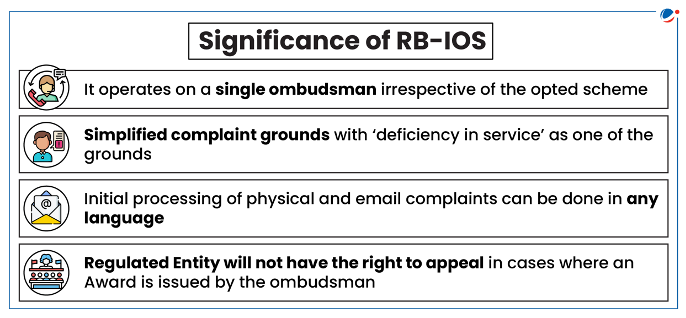

- Background: RB-IOS was launched in 2021 as part of the Alternate Grievance Redress (AGR) Framework of RBI for resolving customer grievances in relation to services provided by the Regulated Entities of RBI in an expeditious and cost-effective manner.

- Integration of existing schemes: It integrated the existing three Ombudsman schemes of RBI:

- Banking Ombudsman Scheme, 2006;

- Ombudsman Scheme for Non-Banking Financial Companies, 2018; and

- Ombudsman Scheme for Digital Transactions, 2019.

- Formation: Scheme has been framed by the RBI in the exercise of the powers conferred on it under the Banking Regulation Act, 1949, the RBI Act, 1934, and the Payment and Settlement Systems Act, 2007.

- Objective: It aims to provide cost-free redress of customer complaints involving deficiency in services rendered by entities regulated by RBI.

- Scheme adopts the ‘One Nation One Ombudsman’ approach by making the RBI Ombudsman mechanism jurisdiction neutral.

- Coverage: Scheme covers the following Regulated Entities:

- All commercial banks, Regional Rural Banks, Scheduled Primary (Urban) Co-operative Banks and Non-Scheduled Primary (Urban) Co-operative Banks with deposits size of ₹50 crore and above.

- All Non-Banking Financial Companies (except Housing Finance Companies), authorized to accept deposits or have customer interface, with an assets size of ₹100 crore and above.

- All Payment System Participants.

- Credit Information Companies (CICs)

- Appointment of Ombudsman: RBI may appoint one or more of its officers as Ombudsman and Deputy Ombudsman for a tenure not exceeding three years at a time.

- Handling of complaints: Redressal/adjudication of complaints is presently handled by 24 Offices of the RBI Ombudsman (ORBIOs) and the Centralised Receipt and Processing Centre (CRPC).

Way Forward

- Utkarsh 2.0: RBI’s medium-term strategy framework (Utkarsh 2.0) has identified the following goals for enhancing consumer protection and improving grievance redress mechanisms:

- Review, consolidate and update the extant RBI regulatory guidelines on customer service;

- Review and integrate the internal ombudsman schemes, applicable to different RE types;

- Establish a Reserve Bank Contact Centre at two additional locations for local languages, including disaster recovery and business continuity facility.

- Technology use: RBI could explore leveraging Artificial Intelligence in the Complaint Management System (CMS) for better complaint categorization, decision-making support and better customer experience.

- For instance, the Consumer Financial Protection Bureau of US collects data by engaging in Financial Well-being Data Survey to design interventions.

- Standardization: Regulated entities should develop a comprehensive Standard Operating Procedure (SOP) for grievance redress based on the inputs received from the RBI Ombudsman.

- Review: The CMS of the REs should be designed in such a way that all rejected complaints are auto-escalated directly to the Internal Ombudsman without any manual intervention.