Why in the news?

Recently, the Ministry of Cooperation constituted the National Urban Cooperative Finance and Development Corporation Limited (NUCFDC), an Umbrella Organisation (UO) for UCBs.

About NUCFDC

- Background

- 2006: The need for an Umbrella Organisation (UO) for India's UCB sector was first emphasized by an RBI Working Group chaired by Shri N.S. Viswanathan.

- 2009: RBI’s Working Group under the chairmanship of Shri V.S. Das recommended a model of a national level UO i.e., NUCFDC.

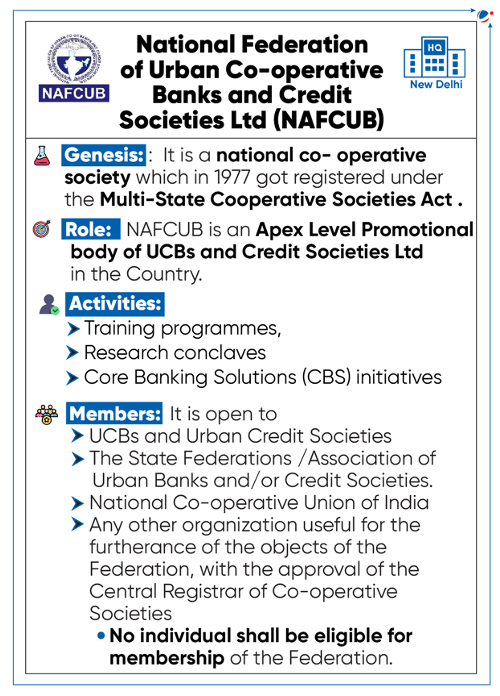

- 2019: RBI accorded regulatory approval to the NAFCUB (National Federation of Urban Co-operative Banks and Credit Societies Ltd) for the formation of NUCFDC.

- Need

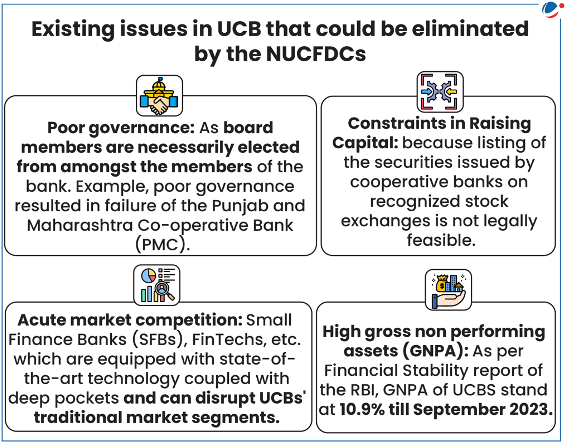

- UO can serve as a gateway for resolving the issues of UCBs (refer to the infographics).

- UO provides an alternative to merger of smaller UCBs, which was earlier done in order improve the economies of scale. (Report by RBI Expert Committee 2021).

- According to the N.S. Viswanathan committee, UO appears to be the only long-term solution to enhance the public and depositors' confidence in the sector.

- Global example: In countries having a large presence of co-operative banks (called credit unions), such as the USA, Canada, and France, cooperative banks are networked closely and thrive under an apex institution known as UO.

- In India, UO will be helpful to modernize and strengthen around 1,502 UCBs in the country.

- Legal status

- NUCFDC is a UO registered with RBI as a Type II -Non-Banking Financial Company-Non deposit (NBFC-ND).

- Type II non-deposit taking NBFCs (NBFC-ND) accept (or intend to accept) public funds and/or have or intend to have a customer interface.

- Contrary to this, Type I - NBFCs-ND do not accept (or intend to accept) public funds as well as do not have or intend to have a customer interface.

- It will be allowed to operate as a Self-Regulatory Organization (SRO) for the sector.

- NUCFDC is a UO registered with RBI as a Type II -Non-Banking Financial Company-Non deposit (NBFC-ND).

Major functions envisaged for NUCFDC

- Offering liquidity and capital support: To raise capital, with plans to reach a capital base of Rs.300 crores to support UCBs.

- NUCFDC can also offer fund management and other consultancy services to UCBs.

- Facilitate regulatory compliance:

- Prepare small banks for compliance with the Banking Regulation Act (BRA), 1949.

- Facilitate communication between UCBs and regulators.

- Develop a shared technology platform: NUCFDC will enable UCBs to widen their range of services at a relatively lower cost.