Reserve Bank of India (RBI) highlighted supervisory concerns in functioning of ARCs during a conference with the theme ‘Governance in ARCs – Towards Effective Resolutions’.

Asset Reconstruction Companies (ARCs)

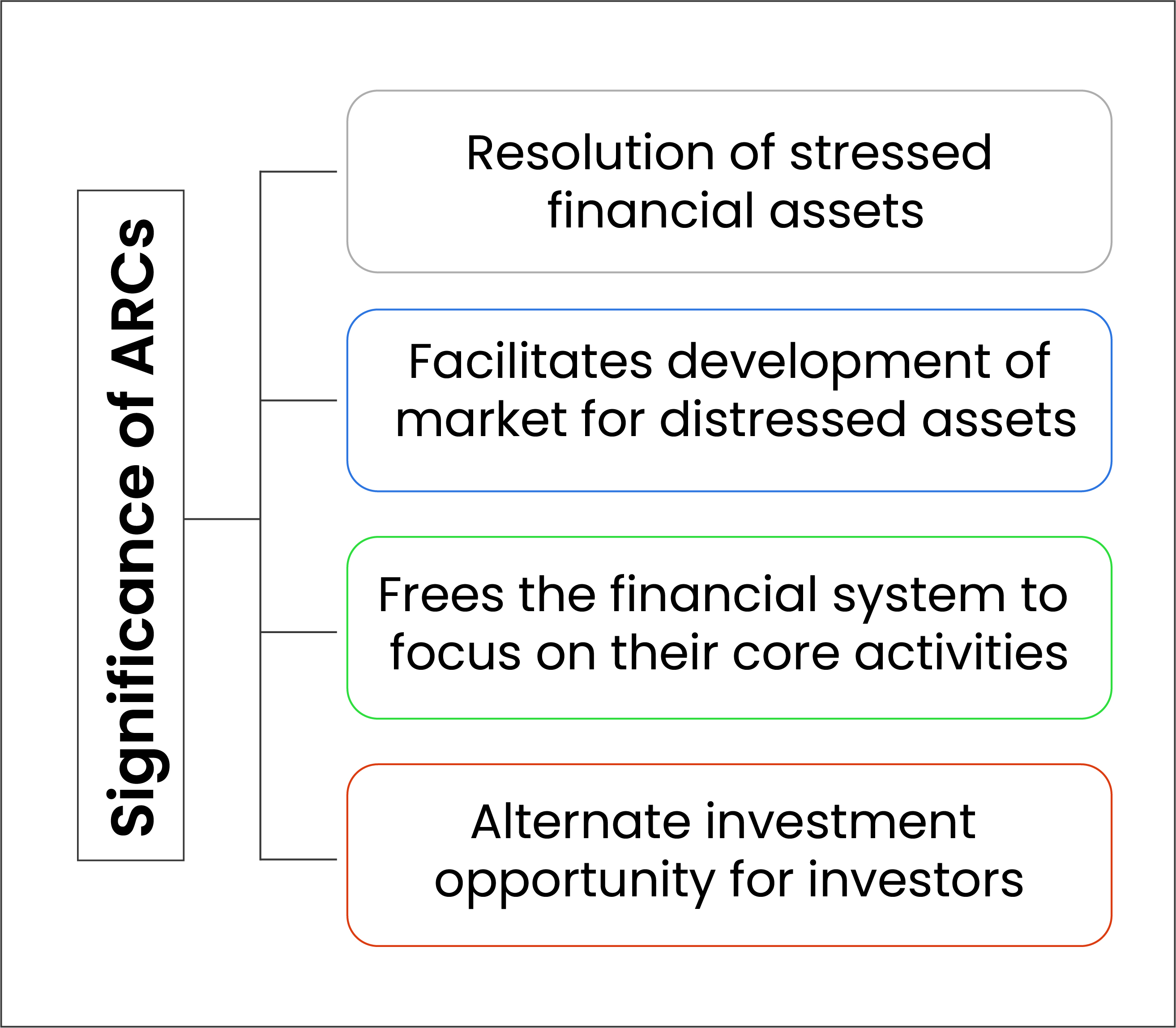

- ARCs are financial institutions which acquire and manage stressed assets from banks and financial institutions.

- ARCs are registered as a company under Section 3 of SARFAESI (Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest) Act, 2002.

Issues with ARCs

- Back-door entry to defaulting promoters of insolvent companies

- Selling of assets to entities with whom the defaulting promoter has struck a deal.

- Lengthy settlement process with borrowers.

- Revival and reconstruction of businesses is mainly for recovery of debts rather than improving business health.

- Non-adherence to transparent and non-discriminatory practices.

Measures to improve ARCs governance

- Develop a strong institutional culture with prioritization of integrity and ethical conduct.

- Follow transparent and non-discriminatory practices in line with Fair Practice Code (FPC) put in place by RBI.

- Accord due importance to assurance functions, namely, risk management, compliance and internal audit.

- Adopt a regulation plus approach, where compliance with the letter and spirit of the regulation is achieved.