Why in the News?

In Budget 2024-25, government has announced to abolish the angel tax for all classes of investors' to boost the entrepreneurial spirit and support innovation.

More on the News

- The Department for Promotion of Industry and Internal Trade (DPIIT) under the Ministry of Commerce and Industry had recommended ahead of budget to abolish Angel Tax.

- Also, a similar recommendation was made by Confederation of Indian Industry (CII).

What is Angel Tax?

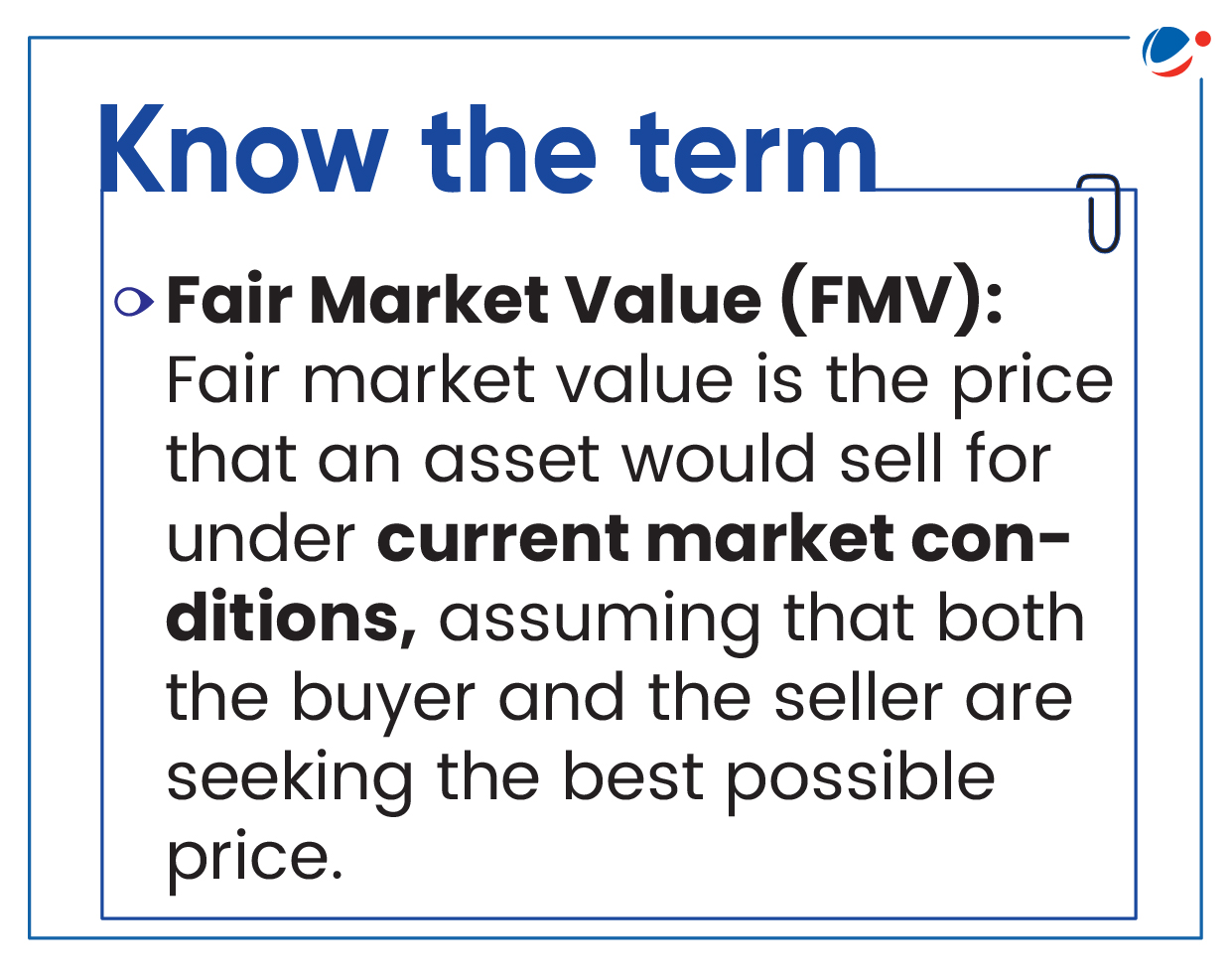

- Definition: Refers to the income tax that the government imposes on funding raised by unlisted companies, or startups, if their valuation exceeds the company's fair market value.

- For instance, if the fair market value of a start-up share is Rs 10 a piece, and in a subsequent funding round they offer it to an investor for Rs 20, then the difference of Rs 10 would be taxed as income.

- Objective: It was introduced in 2012 to curb money laundering and tax evasion.

- Legal Provision: It was levied under Section 56 (II) (viib) of the Income Tax Act, 1961.

- Coverage: Earlier it applied only to local investors but the Budget 2023-24 widened its ambit to include foreign investments (with some exceptions).

Key Sources of Funding for Start-ups

- Venture Capital/ Private Equity/ Angel Funds invest in young and fledging startups.

- Venture capital Fund (including Angel Fund) is considered as Alternative Investment Funds (AIFs).

- AIFs pool private funds for investment in startups and other companies. They have been categorised into three classes:

- Category I: Includes Venture capital funds (Including Angel Funds), Social Venture Funds, Infrastructure funds etc.

- Category II: Includes funds which does not fall in category I and category III and does not undertake leverage. This includes debt funds, etc.

- Category III: Employ diverse or complex trading strategies and are allowed to employ leverage. This category includes hedge funds etc.

- Venture Capitalists: They manage pooled funds from institutional investors and invest in large sums.

- They typically invest in startups that have already demonstrated market traction, have a validated business model, and are ready to scale.

- They seek larger ownership stakes which would in turn give them more influence over strategic decisions.

- Angel investors: They typically invest their personal funds in smaller amounts at an earlier stage when the founder is trying to get his or her venture off the ground.

- There may be more uncertainty and higher risk in investments done by Angel Investors.

Why Angel Tax has been abolished?

- Improves Ease of Doing Business: Angel tax imposed an additional financial and compliance burden on Start-ups thus affecting their growth potential as well as Ease of doing business.

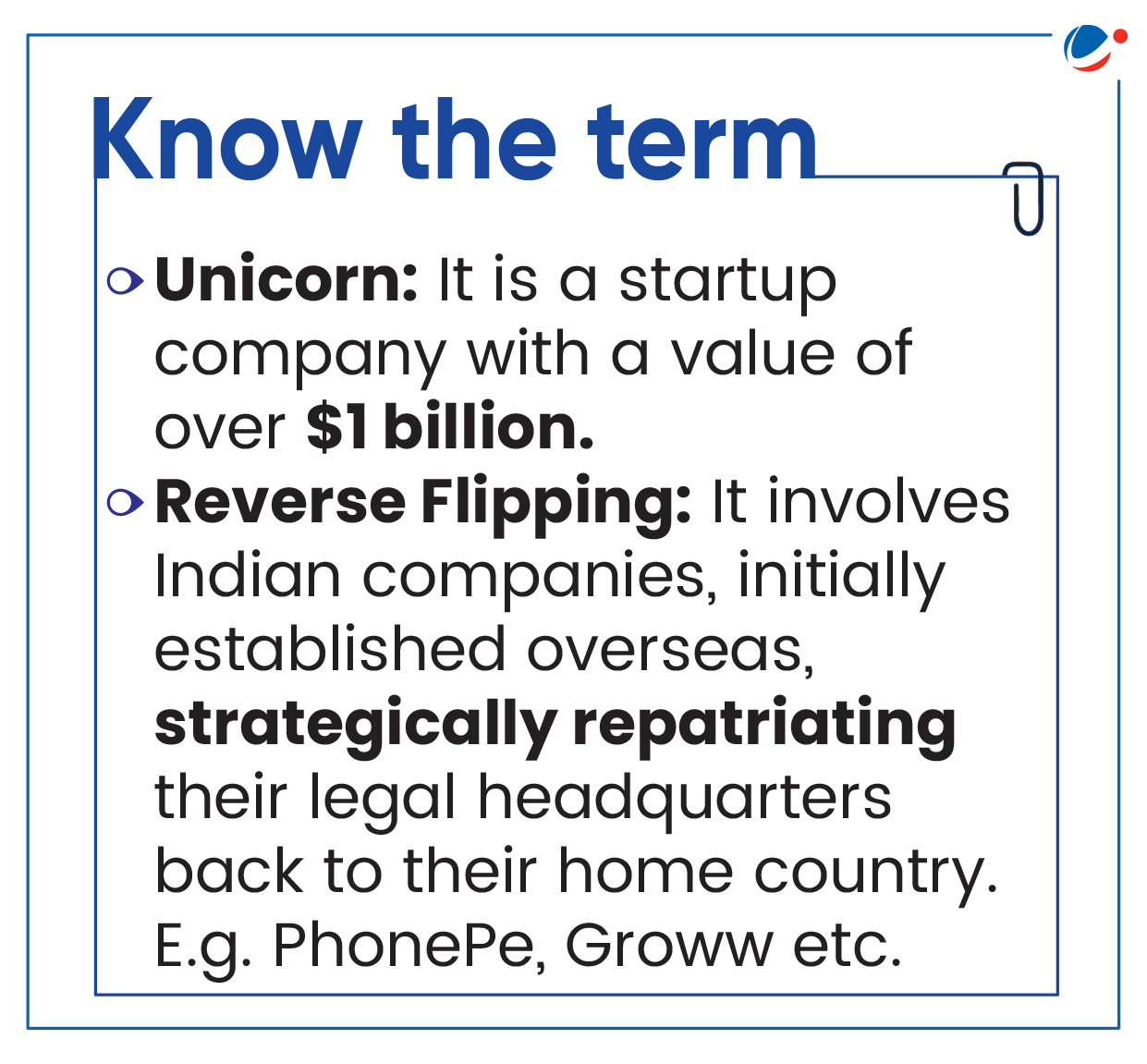

- It will promote Reverse Flipping of start-ups.

- Streamlining Investment: Indian start-ups witnessed over 60 % decline in funding in terms of value in 2023.

- Also, imposition of Angel tax on foreign investors reduced opportunity for Funding. Foreign investor played key role in increasing the valuation of start-ups.

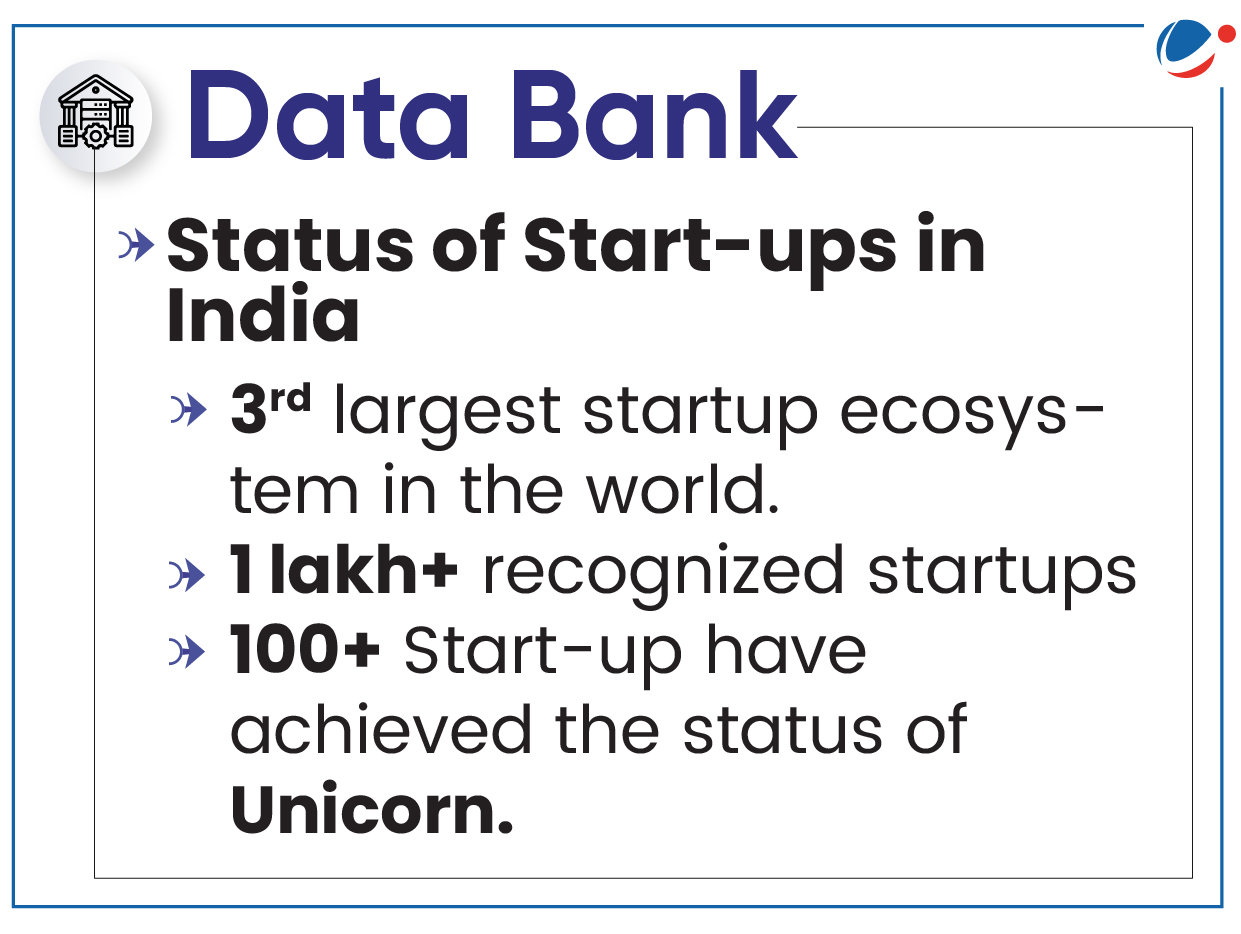

- For instance, Tiger Global (foreign investors in India) has invested in over a third of the start-ups that have turned unicorn, with a valuation of at least $1 billion.

Concerns related with abolishing Angel tax

Abolition will primarily affect the revenue of the government. Additionally, there is an issue that start-ups can be used to launder money or shell start-ups can be created.

What more can be done to improve the financial ecosystem of startups?

Standing Committee on Finance in its report ''Financing the Startup Ecosystem" recommended following:

- Scaling up unicorns: Expanding the Small Industries Development Bank of India (SIDBI) Fund-of-Funds to help disburse more funds to startups.

- SIDBI Fund-of-Funds is a fund that invests in other funds such as AIFs.

- Listing of AIFs: AIFs should be allowed to list on capital markets to access a permanent source of capital.

- Expansion of sectors for FVCI: Foreign venture capital investors (FVCI) shall be allowed to invest in all the sectors where foreign direct investment (FDI) is allowed.

- Mobilisation of domestic institutional funds: Major banks should be allowed to float fund-of-funds and be allowed to invest in Category-III AIFs.

Conclusion

Abolition of Angel Tax will promote fund availability for entrepreneurs. In order to ensure that money laundering and tax evasion do not take place government can emphasise on registration of angel investors and disclosure of beneficial ownership of Private Equity/Venture capitalist/angel funds. This will help in plugging the potential abuse.