Why in the News?

India welcomed its first cargo ship at its newly built semi-automated transshipment port in Vizhinjam International Transshipment Deepwater Multipurpose Seaport, Kerala.

More on the News

- The port is owned by Government of Kerala.

- It is designed primarily to cater to container transshipment besides multi-purpose and break-bulk cargo.

- Port has been developed in landlord Port model with a Public Private Partnership component on a Design, Build, Finance, Operate and Transfer ("DBFOT") basis.

- Under landlord model, port authority acts as regulatory body, while port operations are carried out by private companies.

Transshipment Port

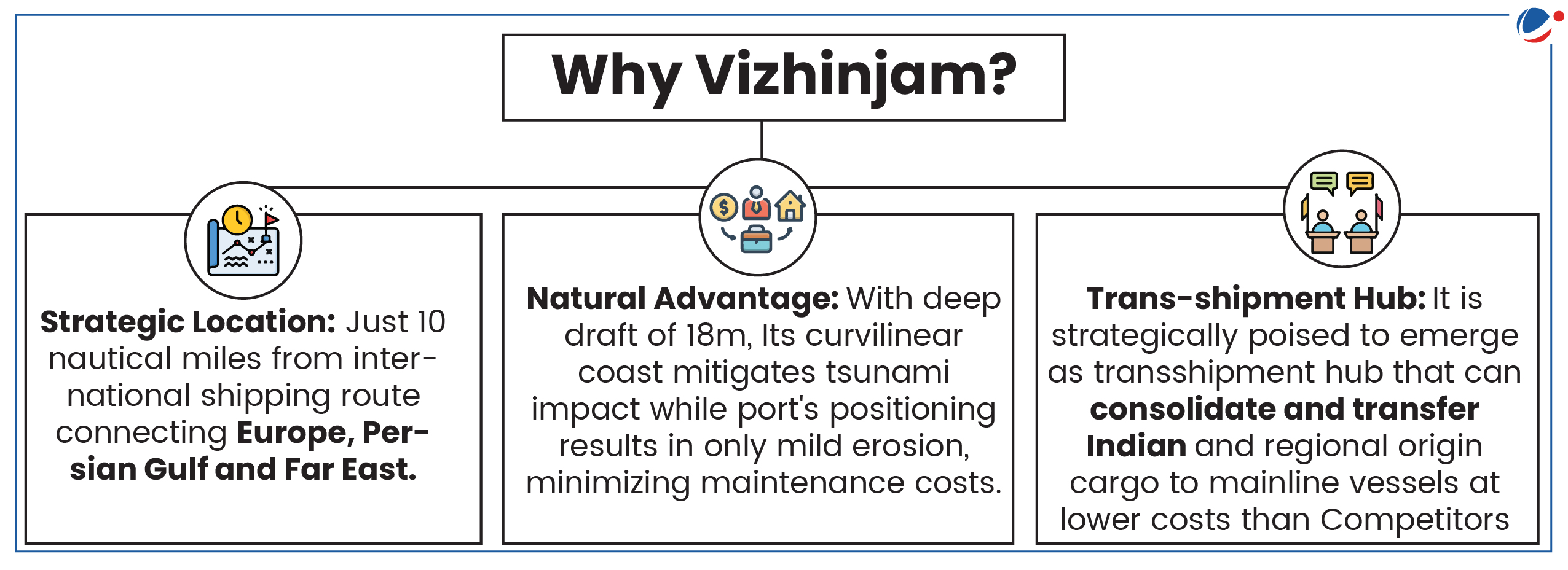

- It is a transit hub where cargo from one ship is transferred to another on the way to its final destination. (includes rails, roads, etc.)

- Smaller parcels of cargo are loaded on a bigger ship which is able to travel to distant ports in other countries.

Significance of India as a Transshipment Hub

- Revenue Generation: Transshipment hub has potential to curb revenue losses for Major ports ($200-220 Million) in transshipment handling.

- Currently, nearly 75% of India's Transshipment cargo is handled at ports outside India.

- Reduced Logistic Costs: It will help in lowering logistic and shipping costs by increasing efficiency.

- Average turnaround time for Indian ports declined from 4.3 days (2012-13) to 2.1 days (2022-23) which still need improvement (Global median ship turnaround time was 1.04 days in 2022).

- Stimulating Economic Growth: Port will significantly result in savings of foreign exchange reserves, attracting foreign direct investment & increased trade.

- Growth of allied businesses will take place around port E.g. Ship repair, warehousing, bunkering etc.

- Self-Reliance: With increasing Chinese influence in port infrastructure in Indian Ocean as part of Belt and Road Initiative, dependence on foreign ports is a potential national security challenge.

- Integration with Global Value Chain: Poor shipping connectivity has hindered India's integration in global value chain. (India's share in world trade is about 2%)

Issues in development of Transshipment Port

- Insufficient Natural Depth: Major Indian ports like Mumbai, Chennai, Mangalore and Tuticorin have natural depths of only 10-14 meters.

- A good transshipment hub requires 20-meter depth.

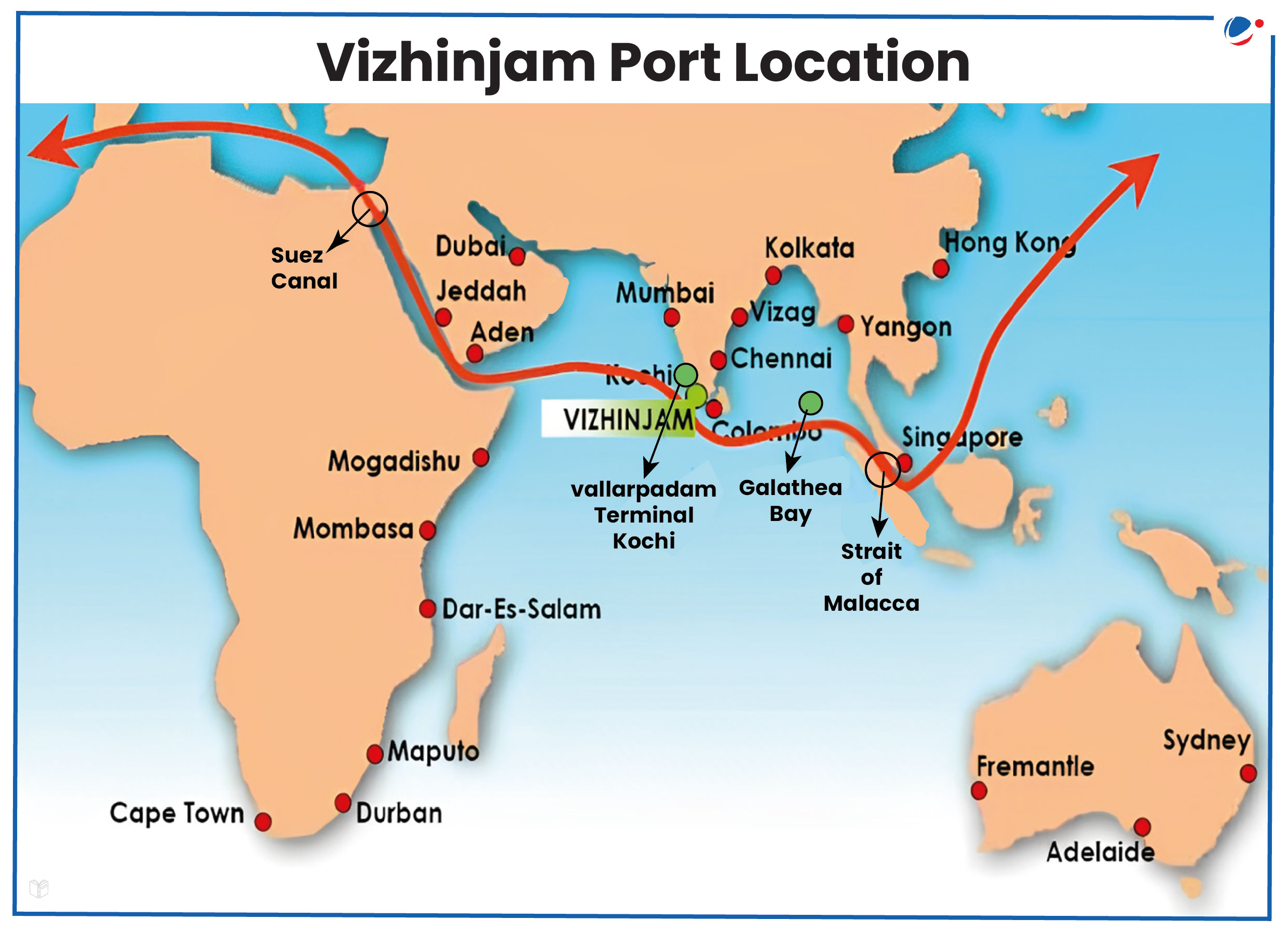

- Distance from international shipping lines: E.g. Our major ports in eastern and western coast are at a distance from major international shipping lines.

- Labor issues: Major Indian ports are bogged with frequent labor strikes, congestions, inefficiency and lower productivity at their respective ports.

- There is often a disparity in skill levels required for advanced port operations versus available workforce.

- Other Issues: Securing Funding, Land Acquisition Delays, Logistics and Connectivity Inefficiencies, Competition from foreign ports (E.g. Colombo, Dubai, Singapore, Jabel Ali, Port Kelang, etc.)

Steps Taken

- Maritime AmritKaal Vision 2047: Outlines a comprehensive plan to transform India's maritime sector. The key initiatives include:

- Deeper Drafts: Increasing draft depths to 18-23 meters to accommodate larger vessels and improve handling capabilities

- Transshipment Hub: Developing a major transshipment hub to capture a larger share of global shipping traffic.

- Reducing Vessel Charges: Implementing measures to lower vessel-related charges to make port operations more cost-effective.

- Private Sector Participation: Boosting private sector involvement through projects under PM Gati Shakti – NMP and the Asset Monetization Plan

- New international Container Transshipment Terminal development at Galathea bay in Great Nicobar (Island of Andaman & Nicobar) and Vallarpadam in Cochin (See map).

- Tariff Guidelines, 2021 provide flexibility of fixing market determined tariff to PPP Operators thereby creating a healthy competition leading to rationalization of logistics costs.

Way-Forward

- Infrastructure Investment: By implementing modern cargo handling techniques for increased capacity at existing ports (especially for dry cargo).

- Public Private Partnership (PPP) Projects: Taxes should be rationalized to attract foreign shipping companies and a single window system should be set up for approving PPP projects.

- Skill Development Initiatives: Launch targeted training programs to upskill local workforce.

- Establishing Centers for Coastal and Inland Maritime Technology in collaboration with IITs/ NITs/ IIMs to provide opportunities in applied research and development.

- Competing with International Ports: Identify key areas for differentiation, such as cost efficiency, turnaround time, and customer service, to position Indian ports favorably.

- Prepare Coastal Zone management Plan (CZMP): Ports may be permitted to prepare CZMP taking into consideration future construction requirements based on earlier environment clearances issued.