Why in the News?

The Financial Action Task Force (FATF) plenary held in Singapore adopted 'Mutual Evaluation Report (MER) of India'.

More on News

- The first Mutual Evaluation of India was adopted in 2010.

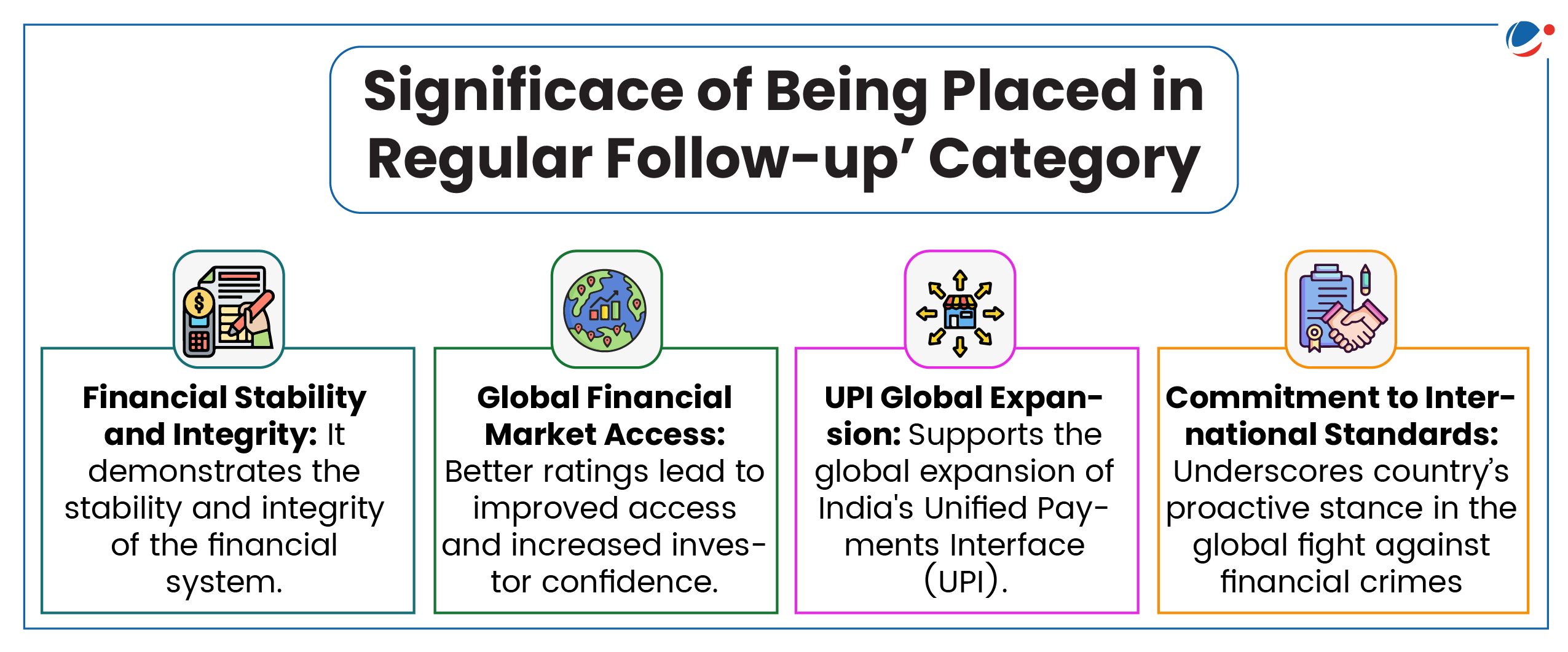

- The current MER places India in the regular follow-up category and recognizes initiatives like JAM (Jan Dhan, Aadhaar, Mobile) Trinity and stringent regulations on cash transactions which have significantly increased financial inclusion and digital transactions, making transactions more traceable.

What is MER of FATF?

- MER is an assessment of a country's measures to combat money laundering and the financing of terrorism and proliferation of weapons of mass destruction

- The reports are peer reviews, where members from different countries assess another country.

- During a mutual evaluation, the assessed country must demonstrate that it has an effective framework to protect the financial system from abuse.

- MER has two main components:

- Effectiveness rating

- Technical Compliance assessment

- Categorization of countries in MER

- Regular follow-up: The top most category.

- Only 24 including India, UK, Italy, France, and Russia (members of G20) are in this category.

- Enhanced follow-up: These are countries with significant deficiencies.

- Includes even developed countries like the US, Australia, and several European nations.

- ICRG review: For High-risk and other monitored jurisdictions

- These have a one-year Observation Period to address deficiencies.

- Failure to address deficiencies may result placement of the countries in the Black or Grey list.

- Regular follow-up: The top most category.

Financial Action Task Force (FATF)

- Genesis: It was established in 1989, by a Group of Seven (G-7) Summit held in Paris.

- Membership: 38 member countries including Russia whose membership is currently suspended (India is a member since 2010).

- FATF Style Regional Bodies: These are 9 regional bodies established for the purpose of disseminating the International standards on combating money laundering, financing of terrorism, & proliferation.

- Key Role:

- Integrity of the international financial system: It is international watchdog to combat money laundering, terrorist financing, and other related threats to international financial system

- It sets the standards for countries and regulated entities (both financial and non-financial).

- Financial inclusion: Supporting financial inclusion became a priority for the FATF in the late 2000s.

- Bringing more people into the formal financial system where transactions can be more easily monitored.

- FATF has also launched 'project on unintended consequences' which includes a focus on financial exclusion.

- Integrity of the international financial system: It is international watchdog to combat money laundering, terrorist financing, and other related threats to international financial system

- Grey and Black List of FATF: These are countries identified as jurisdictions with weak measures to combat money laundering and terrorist financing.

- Grey List (Jurisdictions under Increased Monitoring): Countries that are actively working with the FATF to address strategic deficiencies in their regimes.

- These are countries that have committed to resolve the identified strategic deficiencies within agreed timeframes and are subject to increased monitoring.

- Black List (High-Risk Jurisdictions subject to a Call for Action): Countries or jurisdictions with serious strategic deficiencies.

- For such countries, the FATF calls on all members and urges all jurisdictions to apply enhanced due diligence, and in the most serious cases, countries are called upon to apply counter-measures to protect the international financial system.

- Grey List (Jurisdictions under Increased Monitoring): Countries that are actively working with the FATF to address strategic deficiencies in their regimes.

What makes functioning of FATF less effective?

- Perceived lack of objectivity: FATF makes decisions by consensus, and no formal rules exist as to how many members must object to scuttle a proposal or spare a country from inclusion in grey list.

- Weakness in Listing Regime: There is no recognition of difference between jurisdictions in the grey list that lack the necessary technical or administrative capacity to FATF recommendations and jurisdictions that may have the capacity but would be unwilling in intent.

- Placing non-compliant countries either in black list or the grey list doesn't allow for a flexible and graduated response against terror financing countries.

- Lack of effectiveness: FATF relies upon assurances without actually considering actual performance. For example, Pakistan was removed from its grey list as it implemented FATF recommendations in technical terms.

- However, there still exist lack of action against terrorism and terrorist financing emanating from territories under its control.

- Marginalisation of Global South voices: For many countries in the Global South, it is challenging to justify putting sufficient resources into the fight against money laundering.

- As a result many countries in Africa, for example, appear to be regularly placed on and off the grey list.

- Emerging source of terror financing: The rise of cryptocurrencies and other virtual assets have provided terrorists with new avenues to move funds anonymously and internationally.

Way forward for making FATF more effective

- Categorisation within grey list: Categorisation of countries in grey list based on their willingness to compliance can ensure effective tackling of terror financing and money laundering.

- Enhance transparency in functioning: This can be done by formalizing the appointment at various positions and staff within the secretariat through a transparent and an open competitive system.

- Further, steps should be taken to ensure job security and independence of the secretariat.

- Tailored response to need of poor countries: Countries in need should be provided with special assistance for strengthening their legal, regulatory, institutional, and financial supervisory frameworks.

- Global cooperation: Close cooperation and coordination with other key international organizations, including IMF, World Bank, UN, and FATF-style regional bodies can help FATF to meet its objectives.

- Capacity building: FATF should continuously strengthen its standards to address new risks, such as the regulation of virtual assets, which have spread as cryptocurrencies gain popularity.