Why in the news?

RBI’s annual Trend and Progress of Banking in India report for the financial year 2022-23, showed that the gross non-performing assets (GNPA) ratio fell to 3.9 per cent in 2022-23.

About Non- Performing Assets (NPA)

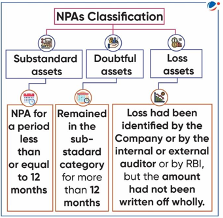

- A NPA refers to a classification for loans or advances of a bank that are in default or arrears.

- A loan is in arrears when principal or interest payments are late or missed and becomes an NPA when the interest and/ or instalment of principal remain overdue for more than 90 days.

- GNPAs are the sum of all loan assets that are classified as NPAs.

Steps taken to reduce NPA

|

Reasons for Non-Performing Assets

- Defective Lending Process: Improper selection and lack of periodic review of the credit profile of borrowers ensuring their repayment capabilities can create NPAs in PSBs.

- Due to a lack of cooperation with financial institutions, borrowers default in more than one bank.

- Willful Defaults: Rising cases of borrower who have access to funds to repay their loans but still choose not to, and default on the repayment of the loan.

- Industrial sickness: Ineffective management, lack of adequate resources and technological changes, and changing government policies produce industrial sickness. Therefore, banks financing these industries ultimately end up with a low recovery rate of loans reducing their profit and liquidity.

- Regulatory: Flouting of RBI guidelines and non-compliance with regulatory directions regarding banking operations by Public Sector Banks (PSBs), can lead to frauds and rise in NPAs.

- Frauds by banker and borrower: The size of frauds in the public sector banking system has been increasing, though still small relative to the overall volume of NPAs.

- In the first half of the 2023-24 financial year (April- September), there is an increase in reporting of fraud cases in the banking sector to 14,483 from 5,396 cases in the same period a year ago (2022-23).

Impact associated with Non- Performing Assets

- Economic growth: Rising NPAs prevent banks from lending for other productive activities leading to a

slowdown in economic activity. It can further lead to a decrease in employment opportunities and inflation.

- Higher interest rates: Increasing NPAs can lead to an increase in interest rates, to cover the losses, which can lead to an increase in borrowing costs for individuals and companies.

- Public trust: Rising NPAs led to reputational, operational and business risk for banks and undermined customers’ trust with financial stability implications.

- Pendency: The courts are facing the problem of increasing pendency of cases, as the current set up of courts made to deal with the problem of debt recovery is not efficient and does not have enough manpower available to deal with the high influx of debt recovery cases.

- Capital adequacy issues: NPAs erode the capital base of banks. When NPAs increase, banks may struggle to meet capital adequacy norms.

Other Highlights of Report on Trend and Progress of Banking in India 2022-23

Concerns raised by the report

|

Way forward

- Government support: Adopting a comprehensive 4R strategy consisting of the Recognition of NPAs

transparently, Resolution and recovery value from stressed accounts, Recapitalising Public Sector Banks (PSBs), and Reforms in PSBs and the financial ecosystem can reduce NPAs and strengthen PSBs.

- Strengthen credit monitoring: Develop an early warning mechanism and comprehensive MIS (Management Information System) to enable timely detection of problem accounts, flag early signs of delinquencies and facilitate timely information to management on these aspects.

- Approval process: Banks should have an established credit approval process, for new credits as well as re-financing of existing credits.

- A comprehensive assessment and periodic review of the borrower’s financial health and repayment capacity should be carried out.

- Institutional mechanism: To cater to large industrial and infrastructure projects and the need for long-term funding, new Development Financial Institutions (DFIs) can be developed.

- Risk Management: The banks can mitigate their potential concentration risk to a specific borrower group, sector, geography, maturity duration etc. which was not initially envisaged at the time of loan origination.

- Encourage banks to diversify their loan portfolios to reduce concentration risk. Overreliance on a specific sector or type of borrower can lead to higher NPAs during economic downturns in that sector.