Why in news?

Recently, the Reserve Bank of India (RBI) has announced new rules and regulations to enhance the scope of Unified Payments Interface (UPI) payments.

More on news

- About new rules

- Enhancing UPI transaction limit:

- The transaction limit for UPI payments made to hospitals and educational institutions has been hiked to Rs 5 lakh from Rs 1 lakh earlier.

- Transaction limit for UPI is capped at Rs. 1 lakh, except in a few categories like Capital Markets (Broking, Mutual Funds, etc.), Collections (Credit card payments, Loan re-payments, EMI), Insurance etc. where transaction limit is Rs. 2 lakhs.

- Increased e-Mandates for Recurring Online Transactions: Limits for execution of e-mandates without Additional Factor of Authentication (AFA) increased from Rs 15,000 to Rs 1 lakh for credit card bill payments, mutual fund subscriptions and insurance premiums.

- Enhancing UPI transaction limit:

About Unified Payments Interface (UPI) and its Features

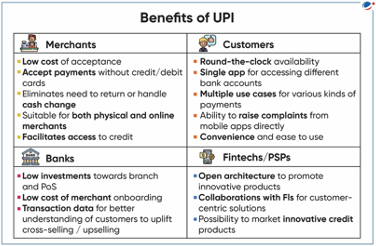

- UPI powers multiple bank accounts into a single mobile application (of any participating bank), merging several banking features e.g., transfer of funds, etc.

- It was developed by NPCI in 2016 and built over Immediate Payment Service (IMPS) infrastructure.

- It is the most successful real-time payment system globally, providing simplicity, safety, and security in person-to-person (P2P) and person-to-merchant (P2M) transactions in India.

About National Payments Corporation of India (NPCI)

|

New Features of UPI

- Credit Line on UPI: It enables pre-sanctioned credit lines from banks via UPI. Earlier, only the deposited amount could be transacted through the UPI System.

- UPI Lite X: Users can both send and receive money offline through any compatible device that supports Near Field Communication (NFC).

- UPI Tap & Pay: It allows NFC-enabled QR codes at merchants to complete payments, with a single tap without entering the PIN.

- Conversational Payments:Hello! UPI: Users can simply give voice commands to transfer funds and input a UPI PIN to complete the transaction.

- Hello! UPI: Users can simply give voice commands to transfer funds and input a UPI PIN to complete the transaction.

- BillPay Connect: Customers can fetch and pay their bills by sending a simple ‘Hi’ message or by giving a missed call.

- Other Proposed Changes for UPI Payments

- Deactivate UPI IDs: National Payments Corporation of India (NPCI) has asked banks and mobile payment applications like Google Pay etc. to deactivate UPI IDs and numbers of accounts that have been inactive for one year.

- The four-hour time limit for users initiating first payments over Rs 2,000 to new recipients to make UPI transactions safe.

- This has added a layer of control and security as it allows users to reverse or modify transactions within that window.

- Introduction of UPI ATMs, allowing cash withdrawal by scanning a QR code.

Initiatives to promote UPI

|

Challenges associated with UPI

- Regulation: Expanding UPI to accommodate a global user base will require adhering to data protection, financial laws and regulations of different countries posing regulatory and compliance challenges.

- Also, significant scalability in terms of software, network and partner banks is required.

- Dominance of Foreign-owned UPI Apps: Parliamentary panel’s report, ‘Digital Payment and Online Security Measures for Data Protection’ recently highlights that foreign entities like PhonePe and Google Pay dominate Indian fintech sector.

- Market share of PhonePe is 46.91% and Google Pay is 36.39% in terms of the transaction volume in October-November 2023, whereas for BHIM UPI it is 0.22%.

- Security and Fraud: Cybercriminals may exploit vulnerabilities in the system or use social engineering techniques to gain access to sensitive information leading to financial losses.

- Exchange Rates: Managing currency conversion and exchange rates while facilitating payments and loading money to the wallet poses a significant challenge for cross-border transactions.

- Lack of awareness: UPI remains a barrier to its widespread adoption especially among individuals with a lack of familiarity with digital payments, leading to financial fraud.

- Privacy and Surveillance: The UPI system ensures end-to-end cryptography, but the regulator i.e. NPCI have access to details of each transaction Aadhaar number, device fingerprint, IP address, bank account numbers etc. This potentially compromises privacy rights.

Way ahead

- Regulation: A collaborative approach among nations, partnership among financial institutions, service providers etc. is required to develop a uniform compliance and regulatory framework among the partner nations.

- Infrastructure: Banks and Payment service providers need to expand their infrastructure in terms of software, network etc. to process higher transactions per second and accommodate a global user base.

- Fraud Protection: A collaborative effort between UPI service providers, banks, and users is required to identify and respond to UPI frauds.

- Transaction limits: Striking a balance between security and transaction flexibility is crucial to drive wider adoption of UPI across various sectors.

- Education and awareness: Training programs and easy-to-understand guides should be designed to educate the masses about the UPI ecosystem and mitigate associated concerns.